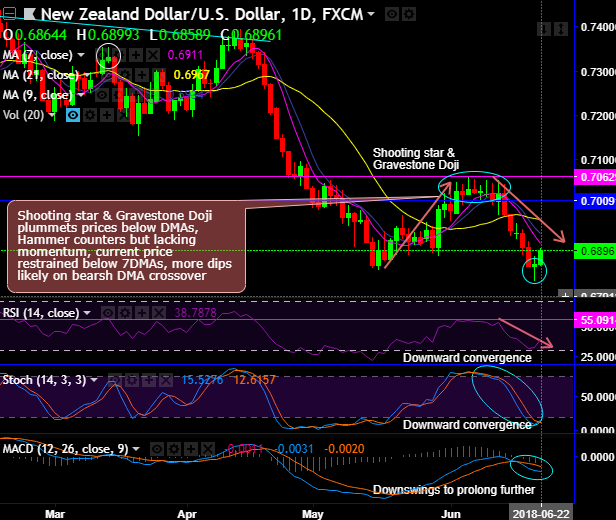

On daily plotting of NZDUSD, bulls bounce-back with hammer pattern candle at 0.6864 levels, we can observe steep slumps below DMAs soon after streaks of bearish patterns, such as hanging man, back-to-back shooting stars and gravestone doji patterns at peaks of rallies.

Bulls in the minor trend counters back after hammer formation but with no convincing momentum.

For now, despite prevailing rallies, trend indicators are not yet substantiating the bullish trend.

While on monthly terms, the bears in the major trend which was in consolidation phase are extending triple top formation. Evidently, steep slumps are observed below EMAs, both leading indicators have been in bearish bias.

The triple top formation with top1 at 0.7485, top2 at 0.7558, 0.7437 levels and neckline at 0.6780 levels, the breach below neckline seem most likely contemplating the prevailing momentum and the trend sentiments.

Momentum study: Both leading oscillators (RSI & stochastic curves) have been showing downward convergence along with the ongoing price dips to signal bearish momentum on both daily and monthly terms, these indicators have been in bearish favor on a broader perspective.

Trend study: While MACD’s bearish crossover that signals downswings to prolong further.

Contemplating above technical rationale, at spot reference: 0.69 levels, boundary options are advocated using upper strikes at 0.6935 and lower strikes at 0.6858 levels. This speculative derivative instrument is likely to fetch magnified yields than spot trades as long as the underlying spot FX remains between these two strikes.

In our earlier posts, we’ve advised short hedges using futures contracts of mid-month tenors with a view of arresting bearish risks, these short positions seem to have been instrumental in serving the purpose.

Overall, as the US dollar finally came to life in the recent past, bears are pushing NZDUSD below its 4-month lows. If it sustains below 0.6950 levels (21DMA), then a further decline towards 0.6850 is on the cards.

Currency Strength Index: FxWirePro's hourly USD spot index is displaying shy above -117 levels (which is bearish), and NZD at -16 (neutral) while articulating (at 06:00 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: