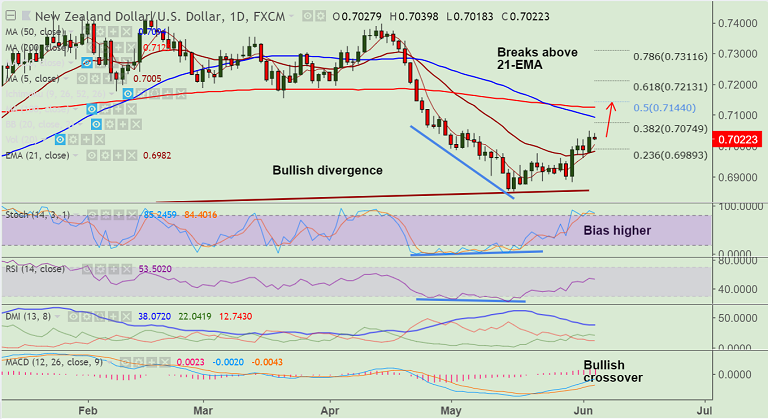

- NZD/USD is extending consolidation after break above 21-EMA, bias higher.

- The major has edged lower from 5-week highs at 0.7048 and is currently trading at 0.7024 levels.

- Technical analysis supports bullish bias. We see a bullish divergence on RSI and Stochs which adds upside support.

- RSI is above 50 levels and biased higher while Stochs show bullish momentum.

- MACD shows bullish crossover on signal line and price is holding above 5-DMA which is sharply higher.

- Next major bull target lies at 38.2% Fib at 0.7075 ahead of 50-DMA at 0.7094.

- On the flipside, we see weakness on break below 21-EMA.

Support levels - 0.7005 (5-DMA), 0.6982 (21-EMA), 0.6882 (May 30 low)

Resistance levels - 0.7075 (38.2% Fib), 0.7094 (50-DMA), 0.71, 0.7125 (200-DMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-USD-Trade-Idea-1334592) has hit TP1.

Recommendation: Book partial profits at highs. Hold for further upside.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 103.368 (Neutral), while Hourly USD Spot Index was at -100.303 (Neutral) at 0545 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.