Despite the attempts of bull swings for the day, we could foresee more slumps in the days to come. Below analysis explains you why:

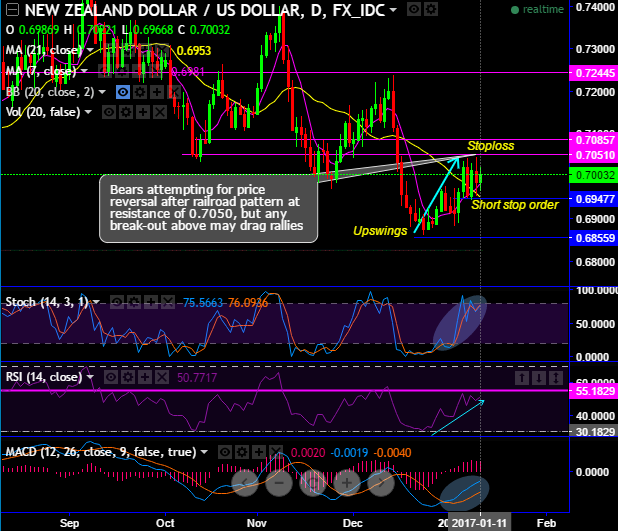

Please note that “Railroad pattern” occurred at the resistance of 0.6959, as a result, upswings struggling to clear stiff resistance at 0.7050 levels. While bears attempting for price reversal after this bearish pattern (railroad pattern) at the resistance of 0.7050, but today’s intraday prices have gone below 7DMA, any abrupt upswings to bounce back may drag rallies maximum upto 0.7050 or even 0.7085 where next immediate resistance is seen.

Upswings sensing resistance at 21EMA (i.e.0.7060), any breakout above may drag rallies while failure swings to resume downtrend in sloping channel.

The recent upswings from last two weeks have consistently rejected below a stiff resistance of 0.7050 levels.

On a broader perspective, shooting stars is traced out 0.7282 levels that evidences the steep slumps (refer monthly charts), consequently, bearish candles with big real bodies and upper & lower shadows occurred consecutively that they finished to seem like 3-black crows.

Rallies rejected again at the stiff resistance of 0.7241 levels and broken major supports0.7038 levels.

To substantiate this bearish stance, both leading indicators (RSI & stochastic curves) evidence the bearish convergence that signals strength and momentum in selling interests.

In addition, MACD’s bearish crossover is just attempting to enter into the bearish zone that indicates the downtrend to prolong.

Trade tips:

Well, as a result of above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 0.7030 and lower strikes at 0.6966 levels.