NZDUSD has been holding up well, against expectations, a 0.7200-0.7345 range likely during the day ahead.

Medium term perspectives: The Fed’s tightening cycle plus US fiscal expansion should eventually reassert upside pressure on US interest rates and the US dollar, pushing NZDUSD below 0.6800 by year end. US factors should outweigh local factors which are mostly supportive. Accordingly, we had advocated below options strategy in order to keep swing risks on check (both short run upside potential and long term bearish risks).

The RBNZ has signaled the next cycle – a tightening one – will not start until the end of 2019. That will anchor the short end, although markets will not abandon their expectations for tightening as early as mid-2018 which means occasional spikes in the 2yr will be likely. A 2yr swap range of 2.10%-2.60% is expected. The long end will continue to follow US yields, which we expect to rise by year end.

Option Trade Recommendations:

All the factors stated above seem to be discounted in FX options market, on 3rd July (at spot reference: 0.7275-0.73 levels) it was advised to deploy diagonal credit put spreads by writing 2w (1%) in the money put while initiating longs in 2m at the money put, the structure could be constructed at the net credit.

By now, you could easily make out short legs on ITM puts of 2w expiries are going worthless as anticipated.

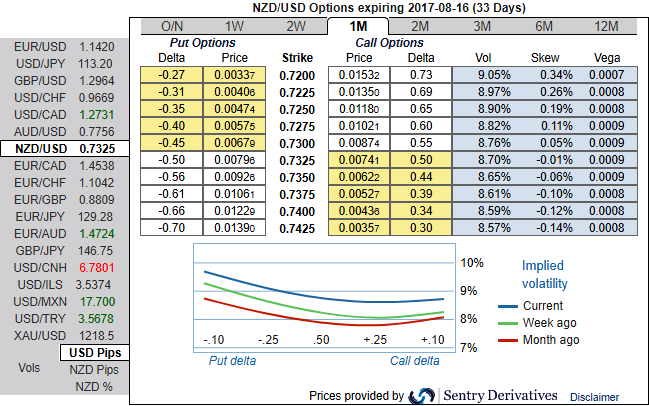

Upon the mounting bearish risk sentiments are observed as you could see the positively skewed IVs in OTM put strikes of 1m tenors (refer positive IV skews indicate the strikes below 0.73 which is our forecasts).

The NZD volatility market normalized sharply (you could observe that in NZDUSD IV skews across all tenors) and IV skewness is quite favorable for OTM put option holders amid ongoing bullish swings, hence, we eye on writing overpriced in the money put options that are likely to reduce hedging costs of long legs.

Well, the positive skews in 2m implied volatilities signify hedging interests in downside risks further and the combination of IV 2w2m skews suggested credit put spreads that has favoured to arrest ongoing upswings in short run and major downtrend has to be taken care by 2m ATM longs.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different