On daily charts moving averages are signifying some price stability which could propel the prices towards north in short term. While leading oscillators like RSI and stochastic are puzzling this uptrend rallies. We think this pair is likely to remain either on sideways or slightly swing upwards but not beyond 82.725 levels in short run. Having said that long term dips are most likely, so as a swing trader with a mindset of gaining these swings on both directions we constructed this strategy.

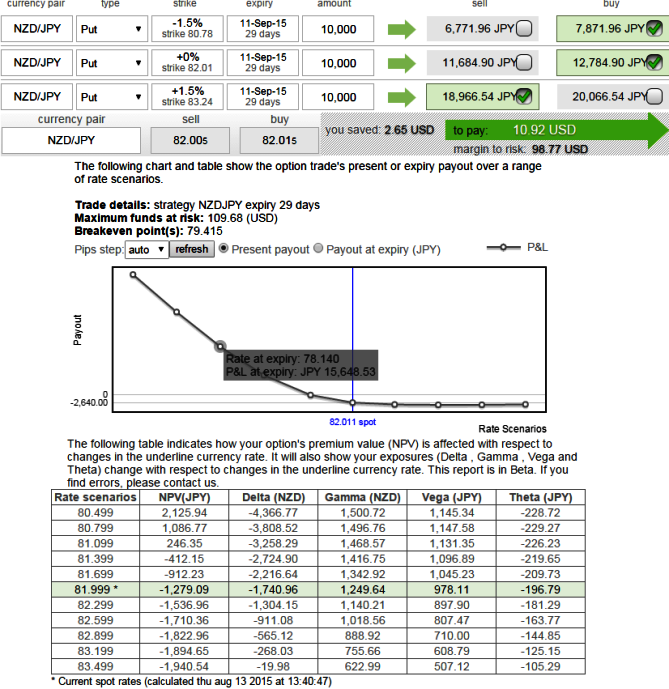

Currency Option Strategy: NZD/JPY Short Put Ladder

Rationale: Unlimited downside and limited upside profit potential

Maximum returns are limited to the extent of initial credit received if the NZDJPY rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of NZDJPY makes a vivid downswings below the lower BEP.

How to execute: Short 7D (1.5%) ITM put option and simultaneously add longs on 15D ATM -0.51 delta put option and one more 1M (-1.5%) OTM -0.34 delta put option.

What does it do with current trend: Since the short put ladder is an unrestricted return with partial risk bearing strategy that is deployed because in addition to the puzzling uptrend in short term and downtrend in long-term, we think that the NZDJPY would also perceive significant volatility in the near term.

How does it affect: Maximum loss for the short put ladder strategy is limited and occurs when NZDJPY price on expiration date is trading between the strike prices of the put options bought. At this price, while both the short put and the higher strike long put expire in the money, the short put is worth more than the long put, resulting in a loss.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand