Nothing wrong about the SGD losing its currency value against greenback on the back of Yuan's devaluation mechanism, USDSGD's spikes would be deemed as continuation pattern for uptrend in this pair that has affected the pair from its external factors, hence we like to remain longs on this pair on every dips.

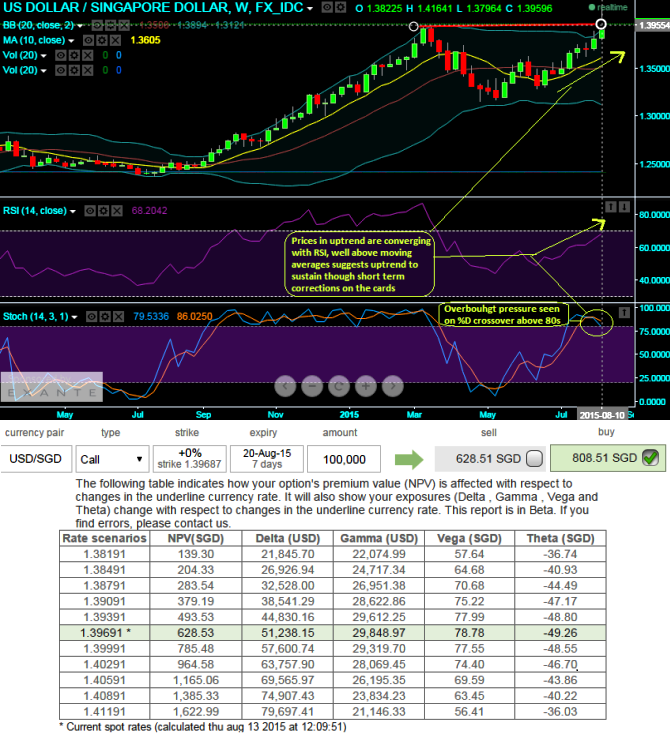

The pair is attempting to break crucial resistance at 1.3950 levels The leading oscillating indicator RSI (14) signals healthy convergence with rising prices as even if RSI curve touches 70 levels which is overbought level. So we think the current dips are only meant for slight correction and it would be temporary.

But on the contrary slow stochastic curve is currently signifying the selling pressure back again as %D line crossover above 80 levels.

Since we anticipate the downtrend in this pair, the At-The-Money delta call of USD/SGD value indicates the option's equivalent position in the underlying market.

ATM calls might be luring for many speculators or hedgers at this moment as the underlying prices going down in an uptrend so that ATM calls are available in cheaper prices.

Let's suppose for instance, as shown in the diagram USD/SGD ATM call option with Delta +0.5 can be delta hedged by selling 100,000 USD against SGD in the underlying FX market.

FxWirePro: USD/SGD uptrend remains intact; delta hedge to confront puzzling swings

Thursday, August 13, 2015 6:46 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate