- NZD/JPY price action rages within the daily cloud which currently spans 75.81-77.72.

- Upside on daily charts has been capped at 78.6% Fib at 77.07, momentum still higher.

- Breaks above needed for further upside, pair holds above 5-DMA after closing above on Monday's trade.

- BoJ will hold its two day monetary policy meeting on 27-28 April where it is expected to decide policy rate and update forecasts inflation and growth figures.

- Reuters poll shows 8 out of 16 analysts feel that the BOJ will take easing steps at 27-28 April meeting.

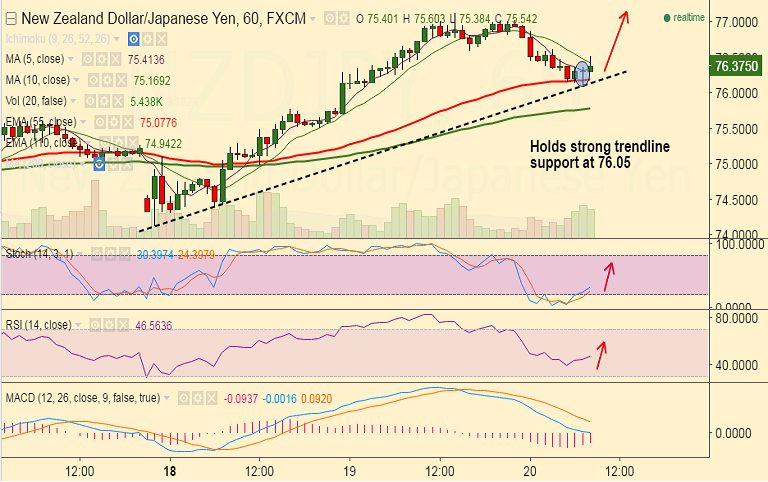

- Technicals on hourly charts show upside. Pair is holding strong trendline support at 76 levels. Weakness seen only on breaks below.

- Next hurdle on the upside located at 77 ahead of 77.44 (Mar 7th highs) and then 77.75 (trendline).

Recommendation: Good to long dips around 76.30, SL: 76, TP: 76.60/77