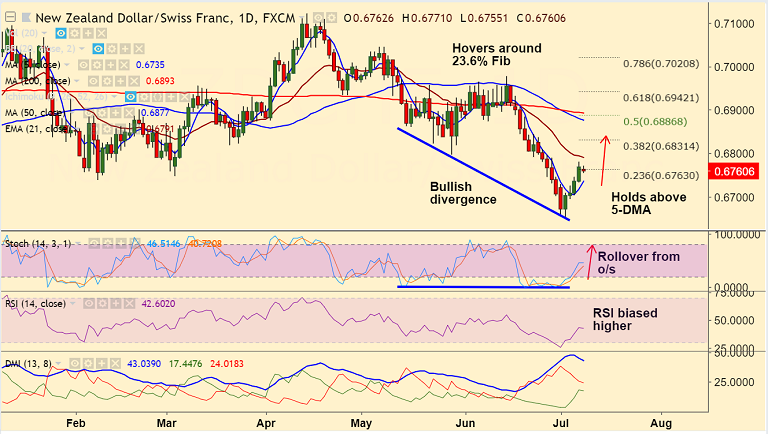

- NZD/CHF is consolidating previous week's gains, trades range bound around 23.6% Fib.

- The pair holds above 5-DMA which is strong support at 0.6736, bias higher.

- Technical indicators are turning bullish. Stochs have rolled over from oversold levels and RSI is biased higher.

- We also evidence bullish divergence on Stochs which raises scope for upside in the pair.

- Upside finds stiff resistance at 21-EMA at 0.6791, break above to see further upside.

- On the flipside, close below 5-DMA will negate bullish bias.

Support levels - 0.6735 (5-DMA), 0.67, 0.6652 (July 3 low)

Resistance levels - 0.6763 (23.6% Fib), 0.6790 (21-EMA), 0.6831 (32.8% Fib)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-CHF-breaks-above-236-Fib-scope-for-further-upside-on-bullish-divergence-1399757) is progressing well.

Recommendation: Watch out for break above 21-EMA for further bullishness. Hold for targets.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at 83.8039 (Bullish), while Hourly CHF Spot Index was at -70.3409 (Neutral) at 0545 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.