Refer NZD/CAD chart on Trading View

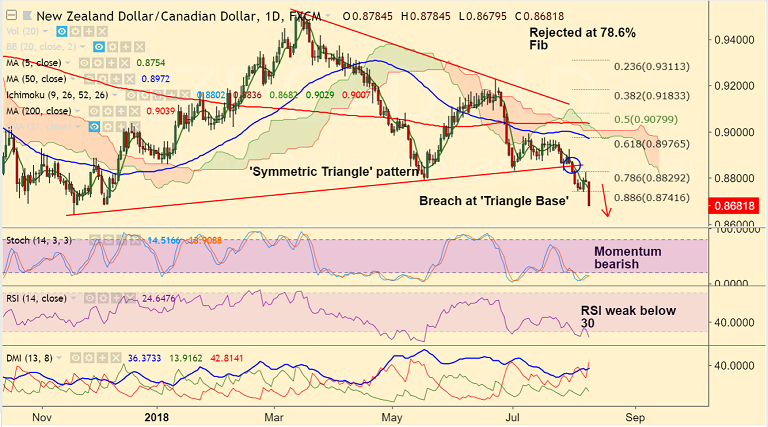

- NZD/CAD has broken support at 88.6% Fib at 0.8741, opening up further downside for the pair.

- Kiwi slumps across the board after RBNZ's unexpected dovish forward guidance.

- The Reserve Bank of New Zealand kept interest rates unchanged as expected.

- However, it surprised markets by revising lower the Sept 2019 interest rate forecast to 1.8 percent from the previous 1.9 percent.

- Further, RBNZ governor Orr said the central bank expects the interest rates to stay at the current level of 1.75 percent through 2019 and into 2020.

- Adding to the bearish pressure around the kiwi was the escalating US-China trade tensions.

- Technical studies support further weakness in the pair. Breach of 'Symmetric Triangle' pattern adds to bearish bias.

- Recovery was rejected at 78.6% Fib on Wednesday's trade. Price slips below 5-DMA.

- Next major support lies 0.8641 (Nov 17 low). On the flipside, break into 'Symmetric Triangle' pattern to see upside.

Support levels - 0.8641 (Nov 17 low), 0.8610 (Apr 2016 low), 0.8584 (Nov 2015 low)

Resistance levels - 0.8741 (88.6% Fib), 0.8754 (5-DMA), 0.88

Recommendation: Good to stay short on upticks around 0.8690/0.87, SL: 0.8760, TP: 0.8640/ 0.8610.

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -32.9275 (Neutral), while Hourly JPY Spot Index was at 27.0931 (Neutral) at 0745 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.