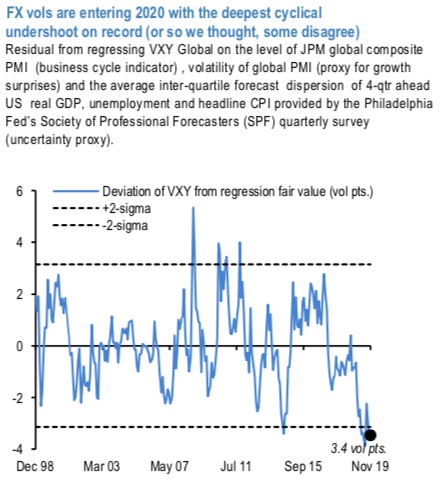

Mixed reception to the notion of FX vol being cheaper has been emphasized in this write-up. Whether it is due to a sunnier cyclical outlook for 2020, a more fundamental change in perceptions of fair value of volatility, or simple fatigue from fruitlessly spending premium to buy options in recent years, we encountered a surprising degree of disagreement around the (what we had thought is an open-and-shut) question of whether FX vol is at record levels of cheapness (refer 1st chart). An element of conflating ‘vol is cheap’ with ‘buy vol’ may have been partly to blame; a few well-worn this-time-is- different arguments involving central bank puts were also trotted out by some accounts who recognize the valuation set-up but nonetheless appeared disinclined to bet on mean- reversion just yet.

On the whole, the pushback bordering on derision from some quarters against the notion of buying vol again – even when our own views /recommendations were far from stridently bullish/long – bore a distinct whiff of capitulation on the part of vol bulls. Despite current eye- wateringly low implied vol levels, we were circumspect around the idea of buying vol at the time of writing the Outlook for reasons detailed therein, but conversations over the past few days make us question whether we should lean contrarian long more forcefully in the new year.

Widespread agreement with long EM vol vs. short DM vol: Even among long vol skeptics, there is acceptance of our argument that the path to higher aggregate FX vol runs through higher EM vol rather than G10 vol. The striking observation on this front is that owning a basket of VXY EM-weighted EM straddles financed with a basket of VXY G7-weighted G10 straddles, delta-hedged, delivered flat returns in 2019 despite a 2 vol+ decline in overall VXY levels, a remarkable demonstration of empirical return convexity from a family of vol spreads that exploded during the risk-market implosion of 2018 (refer 2nd chart).

There is no arbitrage of course; unexpectedly positive developments on the European fiscal front that pushes the Euro sharply higher and invites large scale EUR call buying next year can derail the RV, but so long as one exercises even a trivial caution in currency selection for the short G10 vol leg (avoiding selling EUR vol at 5 for instance), most accounts agreed that it should be possible to set up carry- efficient EM vs. DM RVs that are positively exposed to a negative cyclical tail. As discussed in the Year Ahead, the approach to this is to use a rule-based framework for selecting EM vols to buys while keeping the G7 basket relatively static (currently AUD and NZD) given the paucity of half-decent value in option-selling targets there. Courtesy: JPM

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different