This pair has been tumbling after Brexit event as the buying momentum is reduced and the long-term downtrend seems to be intact for now as the massive volumes are convincing this bearish environment on monthly charts.

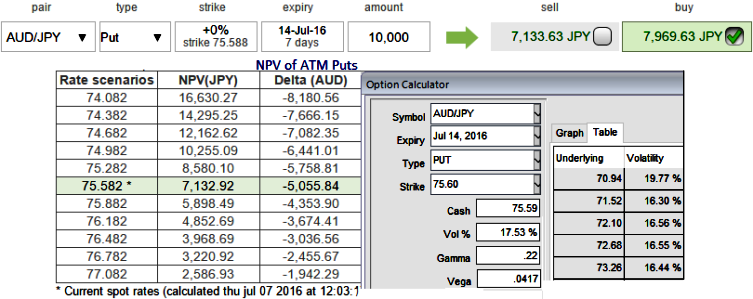

While IVs of ATM contracts of 1w and 1m tenors are trending above 17.53% as we have flurry data announcements in Japan, namely, current account balance for today.

Upper house elections are slated during this weekend. Preliminary and core machinery orders, PPI, and industrial production are scheduled for the next week.

These volatilities have been justified by historical volatilities in spot FX fluctuations.

On the flip side, ATM premiums of 1w expiries are trading at shy below 11.75% and there exists the disparity between IVs and option premiums which we perceive this as an under-priced option.

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy. The implied volatility of 1M ATM put contract is at 17.44% and it is quite higher side when long-term trend is bearish and spikes in previous rallies for the short term which is a good sign for option writers. Thus, in such higher vols situation, the under-priced options are luring factor in any option strategies.

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy which we’ve formulated as below.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favor but in AUDJPY case we have a very rare opportunity in under-priced puts. If IV increases and you are holding an option, this is good. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 1W one lot of (1%) In-The-Money put option.

So far we all know that the position uses long and short puts in the ratio, such as 2:1 or 3:2 and so on to maximize returns depending upon risk appetite and returns expectations.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics