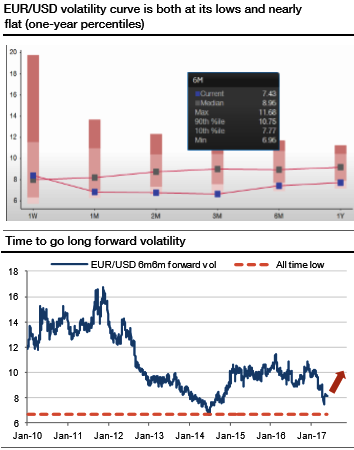

After the French presidential election, the EURUSD volatility curve aggressively sold off, reaching its lowest level since 2014. Since then, implied vols have bounced only very timidly and are still very close to their recent lows (refer above graph). Interestingly, the curve is usually quite steep when vol is globally low, and conversely, it tends to flatten or even invert when vol rises. The current configuration – a nearly flat curve combined with low volatility – looks like an anomaly, as the vega part should include a term premium when the front end is very low.

Curves are usually driven by the front end, and the risk priced there is then diffused towards the longer tenors. But even if short-term volatility remains subdued, we can contemplate the steepening being driven by the vega part of the curve in a context where the market is not shaken by near-term fears but starts discounting the medium-term outlook. EURUSD 6m volatility in six months offers a great opportunity, as it is trading only about one volatility point above its all-time low (refer above graph).

The uncertain and reflationary environment should involve a premium in vega vols, with the flat curve making forward volatility very attractive to buy. We recommend going long an EURUSD 6m6m forward volatility agreement at 7.8.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data