USDCAD caught between several factors, such as the ongoing storm-cloud of US trade policy escalation, NAFTA, crude prices and an otherwise constructive cyclical outlook that is still warranting gradual rate hikes.

Price action for the past month is a textbook example of this dynamic, with a partial round-tripping of the pair from 1.30 in early June to intraday highs near 1.34 in late June as US-China tit-for-tat trade war fears spilled over into the NAFTA read-through, then retracing back to around 1.31 in early July as BoC looked through these risks and resumed hiking policy rates.

The intermediate trend of USDCAD has bearish but the higher crude oil prices likely to cushion on easing US-Iran tensions, focus on API inventory data.

On the contrary, loonie seems to be suffering since this morning from the lingering rumours that Canada was explicitly excluded from this week’s NAFTA talks between Mexico and the US. To me, it seems premature to expect a termination of NAFTA in the near future.

The Mexican government has already signalled that it would not aim for a bilateral agreement with the US, but continue to support a multilateral structure.

In addition, Canada remains a close trading partner and ally of the US. That is why we reckon that a too pessimistic view on the Canadian dollar is not justified at this point. Moreover, the Bank of Canada will probably remain unimpressed by the trade tensions and hike its key rate once again during the remainder of the year.

OTC Outlook:

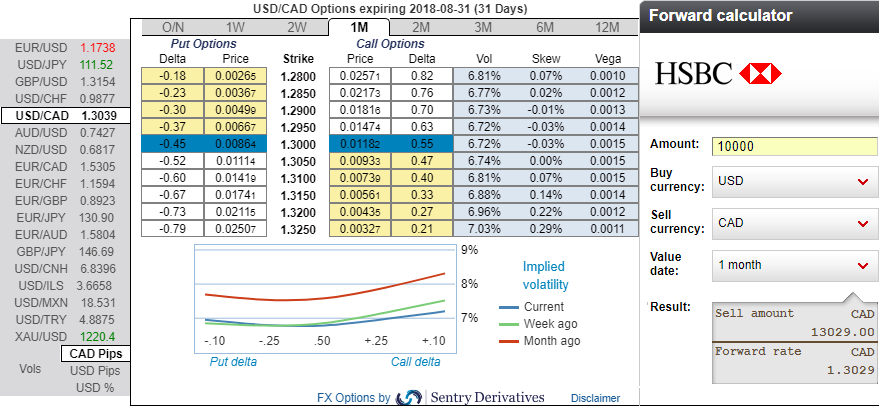

Please be noted that the 1m IV skews are well balanced on either side and stretched out for both OTM puts and OTM calls, while bullish hedging bids remain intact for the long-term. While 1m forward rates indicate bearish targets.

Accordingly, we uphold staying short USDCAD through a low-cost RKO: The USDCAD put RKO was originally conceived as a low-cost option to gain exposure to what seemed like a decent chance of a near-term breakthrough in NAFTA negotiations.

Now what seems most likely is that the option will expire worthless, particularly after the latest developments in the US Trade policy which seemingly swung the tone of NAFTA negotiations back to an antagonistic one where Trump has once again publically hinted about the possibility of pulling out.

Hence, we advocate staying short in 1w USDCAD forwards with a view to arresting potential bearish risks in the near-term and longs in 3m forwards.

Alternatively, buy 2m 1.30 USDCAD put, RKO 1.27, spot reference: 1.3035.

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -53 levels (which is bearish), while hourly USD spot index was at -83 (bearish) while articulating at (11:58 GMT). For more details on the index, please refer below weblink:

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell