AUDNZD in 1-3 months timeframe, one could expect the lower side to 1.0225 levels and also at 1.0745 levels on the higher side. The cross remains well below fair value estimates implied by interest rates, commodity prices, and risk sentiment, but for now, retains negative momentum, targeting 1.0415 during the next day or two. For now, the pair dropped from the highs of 1.0506 to 1.0463 levels.

RBA is scheduled today for the announcement of cash rates and policy statement which is likely to maintain status quo (cash rate to remain at 1.50%), but policy statements to provide little volatility in FX markets.

On the other hand, the RBNZ ended its easing cycle on 10 Nov and will now remain on hold for a long time. That will anchor the short end somewhat (although the 2yr-OCR spread – one measure of stretchedness – has been even higher than the current 50bp during past on-hold periods), with the long end free to follow offshore yields.

ANZ Commodity Price Index for November is out, while Australia has a couple more key partial indicators for Q3 GDP (inventories and profits).

Kiwis’ exports shot up by 2.2 pct due to higher sales of dairies, while imports increased by 0.2 pct driven by increase in purchase of capital goods, which in turn led to NZ trade gap of NZD 846 million in October of 2016, compared to NZD 904 million deficit a year earlier and better than market projections of NZD 950 million deficit. It was the smallest gap recorded since July when the trade balance swung into deficit.

OTC outlook and Option strategy:

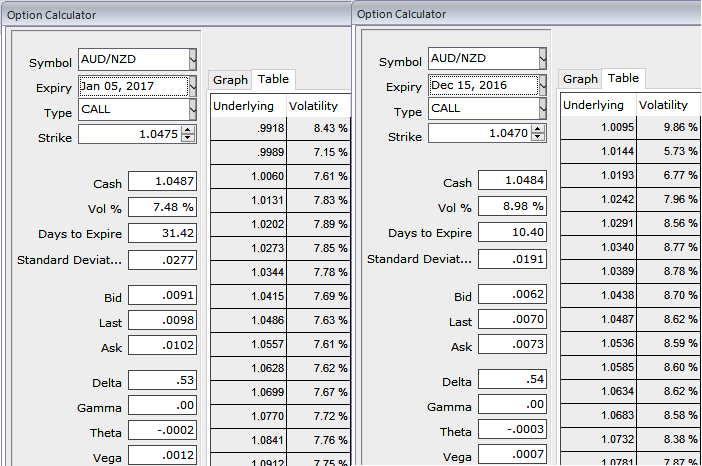

There could be a little volatility this morning as markets await the outcome of the Italian referendum. You could observe that the 1m and 10d ATM IVs are trading at shy above 7.45% and a tad below 9% respectively.

On both hedging and speculative grounds, you could initiate following option positions to construct straps strategy in order to keep underlying spot FX prices on check ahead of the above stated fundamental news.

The execution: Buy 1m ATM -0.49 delta put option, while 1w ATM +0.51 delta call and one more ATM +0.51 delta call of 2w expiries, the diagonal tenors are chosen so as to favour the short term uptrend as well as major downtrend, by keeping so the trading cost is reduced with net healthy delta on the strategy.

As shown in the diagram one can obtain positive cashflows from this strategy regardless of the swings and puzzling underlying prices could be kept on the check as you have the right buy or sell underlying spot at prevailing prices since we hold both calls and put options.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data