Turkish Fiscal policy: The lira turned notably volatile yesterday as Finance Minister Berat Albayrak unveiled a new economic reform programme. But, the currency settled down later as markets realized that this is a plan only for the remainder of 2019; deeper reform programmes covering the entire four and a half years until the next election will follow later.

In terms of the proposals themselves, we view them as mostly reasonable - but, we should be realistic about their impact. Just to give short examples, reform of the food supply chain to remove bottlenecks and streamline supply is no doubt a valid step. Only we should not view this is a necessary or sufficient step to tackle inflation broadly.

Similarly, under some circumstances it can be useful to offload certain NPL's from bank balance sheets into a special 'bad bank' or venture fund – it may remove some obstacles for the banks' day to day performance while allowing investors to buy potential assets. But, this does not mean that market participants should forget about how these liabilities were created and suddenly view the banks as healthier. The corporate tax rate is set to be gradually reduced.

It is worth noting that the tax rate was raised from 20% to 22%; the original 20% is not much higher than in peer countries – so there is no rationale for reducing the tax rate by much, longer-term. In fact, a front-loaded cut could help the flailing economy, as the budget deficit is narrow right now. But a low tax rate will not turn out to be some magic pill. In this way, as long as we understand the measures to be what they are, the programme appears reasonable. There should not be unrealistic expectations such as that the inflation problem was addressed, or that the increase in FX liabilities as a result of the weaker lira no longer matters. We forecast USDTRY to trend upwards over the coming months.

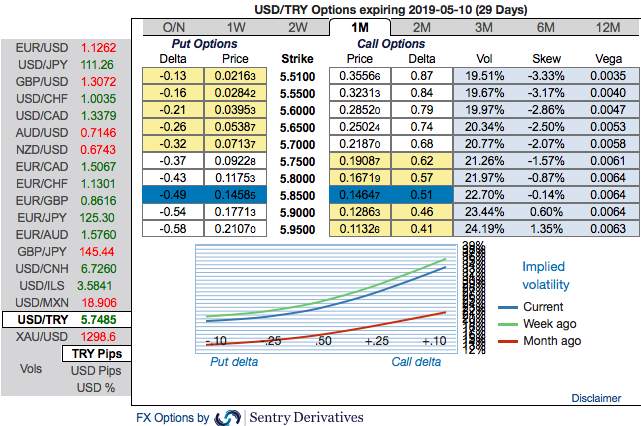

Trade tips: 3m USDTRY debit call spreads are advocated with a view to arresting upside risks. Initiate 3m 5.30/6.54 call spreads at net debit. Thereby, one achieves hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

The rationale for the trading: Please observe that the above technical chart is also clearly indicating the further upside risks.

While positively skewed IVs indicate the upside risks, the hedgers of TRY are positioned for bearish risks contemplating the above fundamental factors.

IVs of this underlying pair is on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is desirable for the holder of the option, just for the intuition that the higher likelihood of the market ‘swinging’ in holder’s favor. Please also be noted short-dated options are less sensitive to IV, while long-dated is more sensitive. Courtesy: Commerzbank, Sentry & Tradingview.com

Currency Strength Index: FxWirePro's hourly USD spot index is flashing 52 (which is bullish), at press time 13:29 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields