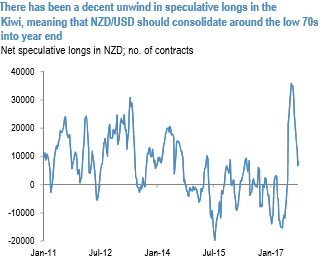

We continue to look for a lower NZD over the coming year, as tight financial conditions, weaker growth, a housing market that has peaked and a policy rate more likely to go down than up in the next year all weigh on the Kiwi. A combination of weaker data and uncertainty ahead of the general election has driven a decent position adjustment in NZD of late (refer above chart), so our 4Q’17 target of USD0.70 is only 1.8c below current levels.

However, our 3Q’18 target remains USD0.66. We expect NZD to fall over the next twelve months, as growth will likely continue to underperform the RBNZ’s lofty forecasts (refer above chart), housing slows, and as tight financial conditions restrain any requirement for OCR hikes, allowing rate compression vs USD.

We are also of the view that, while systematic/model-based investors might struggle to sell NZD given where the terms of trade are, this is only an anchor for valuations to the extent it predicts growth, inflation, or the current account. On these fronts, we see the details as being less bullish than they appear.

We’ve been broadly neutral on the dollar (a solitary call spread in EURUSD) but open a tactical long in NZDUSD following the miss on core CPI. The USD index is 1.5% stronger than before the overshoot in the August CPI.

In addition, longs in NZDUSD NZD is encouraged, this pair has been one of the few major currencies which screens cheap against the USD on our high-frequency models. On 2Y regressions, for instance, NZDUSD is 1.3 sigma undervalued compared to AUDUSD which is 0.5 sigma overvalued and the overall USD index which is 1.3 sigma cheap. This valuation gap in part reflects a residual political risk premium as government negotiations have yet to be concluded following the inconclusive general election.

The indications are, however, that NZ First will be in a position to indicate its preference early next week. For a tie-in with the incumbent National Party in keeping with constitutional precedence (this may entail a looser ‘cross-benches’ arrangement rather than a formal coalition). This should reassure investors and prove a modest fillip for NZD given their anxiety about potential institutional reform of the RBNZ under an alternative Labour government.

At spot reference: 0.6975, we advocate buying NZDUSD at 0.7189, stop at 0.6860. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -70 levels (which is bearish), while hourly USD spot index was at shy above 102 (highly bullish) at the time of articulating (at 07:20 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One