NZDUSDretains downside traction, targeting 0.65, the prices sank from the peaks of 0.6305 to the recent lows of 0.6255 which is the lowest level since 2015.

The medium-term perspectives: The RBNZ has demonstrated its willingness to take bold steps, which means markets are likely to remain dovishly positioned for some time. In contrast, the Fed is more measured, which means the NZ-US yield spread is likely to weigh on NZDUSD.

In addition, slowing global growth and trade wars will be headwinds. All this suggests further downside potential for NZDUSD, our month-ahead target 0.6050.

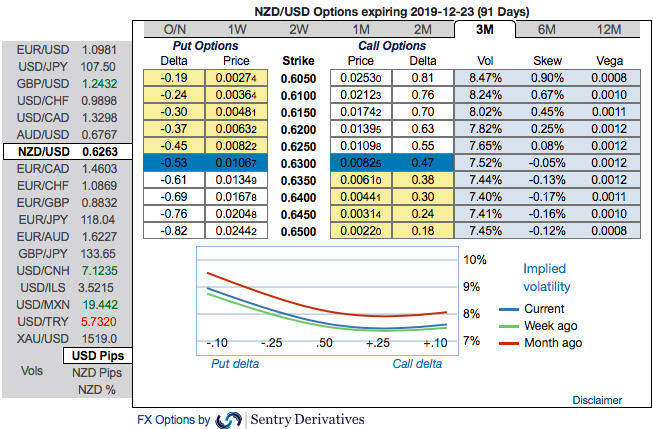

Most importantly, 3m IV skews are also in sync with the NZD’s bearish projections that have clearly been indicating downside risks. Hence, the major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid any abrupt rallies.

These positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.6050 levels (refer above nutshells evidencing IV skews).

The global risks are reckoned to play less conducive for NZ than they do for Australia, and the central bank has reason to be credibly dovish even as the data have outperformed some of the downside risk scenarios laid out earlier in 2018. NZD is expected to depreciate to 0.60 by year-end, accordingly we deploy suitable options strategies.

While the NZDUSD trade is underwater following positive news reports on a US-China agreement. The erratic nature of news flow is one reason why we had suggested NZDUSD shorts via options in the past that with ITM put instruments which are most suitable amid prevailing conditions. 3m NZDUSD (1%) in the money put options have been advocated, in the money put option with a very strong delta will move in tandem with the underlying.

The trade projection is now out of the money but we maintain exposure given tail risks to high beta FX as noted earlier. Courtesy: Sentrix & Westpac

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty