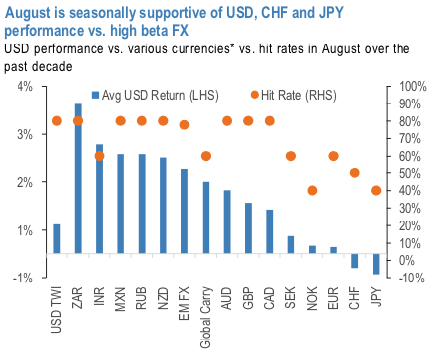

RBNZ has traditionally been somewhat more sensitive to global developments. A rate cut is already essentially fully priced for next week, and expectations increasingly seem to be for a dovish outcome. The combination of disappointing local business confidence data along with renewed global concerns could still manage to tilt the policy meeting dovishly as a result (we still view the terminal rate ultimately arriving at 1% given current growth and inflation undershoots). Positioning as of earlier this week has also lightened up recently which projects scope for further NZD downside (refer 2nd chart). And as described above, both AUD and NZD tend to be laggards in the month of August, and given the current risk and central bank environment, seem poised to deliver another month of antipodean underperformance (refer 1st chart).

For these reasons, we increase our high beta exposure by layering in a new NZDUSD short in cash to capitalize on both an underwhelming local story along with the defensive risk environment. Meanwhile, the uptick in vol and strong move in the spot has brought our NZDJPY back into the green and remains another core expression of a defensively-oriented portfolio. Ultimately, August looks like it could be a long month between now and the September 1 tariff deadline, which seems liable to keep NZD on the back foot.

NZDJPY’s two-month-old decline remains intact, with below 69 levels looks vulnerable in the near term. Global risk aversion over the past month has boosted the yen’s appeal.

In the medium-term perspective, we foresee further slumps at year-end. BoJ monetary policy is likely to remain accommodative for an extended period.

Trade tips:

Uphold a 6m NZDJPY put spread. Bear put spread (35d/15d strikes) (Spot reference: 69.613 levels). Paid 1.07% at the end of May. Marked at +1.13%.

Alternatively, we foresee NZDUSD major downtrend continuation up to 0.64 levels, shorting futures of mid-month tenors have been advocated ahead of RBNZ monetary policy with an objective of arresting further potential slumps, we wish to uphold the same positions. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: JPM

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says