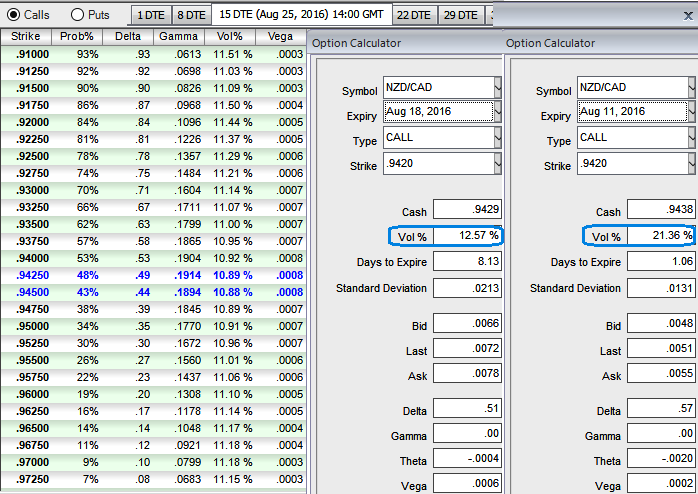

Please be noted that the ATM IVs of 1D and 1W expiries of NZDCAD are spiking at sky rocketed pace, 21.36% and, 12.57% respectively. This heaped on noise in NZDCAD OTC operations are owing to today’s RBNZ monetary policy, which is likely to ease with 25bps, at an all-time lows to 2.00%.

NZD is exposed to RBNZ cuts and a Chinese slowdown. The CAD will benefit from residual USD strength (North American bloc) and further oil price gains in the long run which seem to be dubious at this juncture.

So, long term investors and traders are advised to take profits in NZD/CAD and like to reopen it with a hedging strategy following large NZD gains recently.

FX Option Trading Strategy:

Strategy: 3-Way Diagonal Straddle versus OTM Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Let’s glance on sensitivity tool for put options of this pair, it flashes up higher probabilistic numbers for OTM strikes which would mean that higher likelihood of expiring these contracts in-the-money.

As we have ATM implied volatility of these contracts of 1w tenor are on higher side, thereafter in a steady pace creeping up above 12.57%, synthesizing all these aspects in a go, the higher IV implies the market reckons the price would more likely move towards these put option strikes, as a result we reckon it is beneficial for OTM call strikes writers.

At current spot at 0.9438 the pair is likely to move towards lower strikes in volatile markets caused by data season as stated above, we would like to position the option trades as shown below so as to match the sensitivity tool indications.

The execution:

Go long in NZDCAD 1M at the money -0.49 delta put, and go long 1M at the money +0.51 delta call and simultaneously, Short 2W (1%) out of the money call with positive theta.

These trades reflect the Antipodean exposure to China, likely rate cuts, and preference for oil over base metals. In both cases, valuation remains appealing. The CAD and NZD are our least-preferred G10 currencies for H2.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal