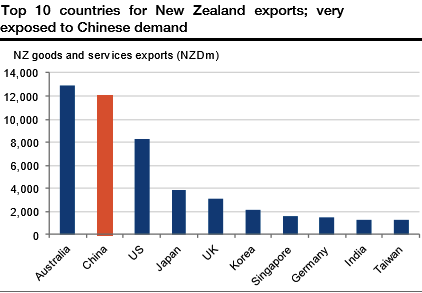

Fading Chinese growth and commodity prices remain a major risk for commodity currencies. More specifically, China remains the second destination for NZ exports, just after Australia and before the US. Any slowdown in Chinese demand will weigh on NZ growth and reduce the inflows, therefore weighing on the currency. We expect NZDUSD to fall to 0.64 by end-2017.

Downside medium-term kiwi volatility is expensive if we consider that NZDUSD 1y implied volatility rose above 12 while 3m realized volatility sharply fell after the summer to return to around 10. Since June, NZDUSD has been trading in the 0.70-0.74 range after a bullish first semester. We expect the down move to be relatively slow next year, and in any case, it is unlikely to lift implied volatility even higher compared to the mild spot dynamics. The skew is also decisively oriented towards dollar puts, such that the volatility picture suggests selling the kiwi via RKO puts.

We expect the NZD to fall the most against the USD in 2017, reaching 0.64 by year-end. New Zealand remains highly exposed to a slowdown in Chinese demand, and the RBNZ won’t stay neutral in front of revived currency strength. Short rates already point toward a much lower NZDUSD. Downside medium-term kiwi volatility is expensive, suggesting RKO puts. Buy NZDUSD 1y put strike 0.68 RKO 0.59 for 0.98% (spot ref: 0.6997), which compares with 3.85% for the vanilla.

We recommend buying a NZDUSD 1y put with a strike at 0.68, just below the 0.70 resistance, and an American knock-out barrier at 0.59, just below the 0.60 psychological support and five figures below our end-2017 forecast of 0.64. This trade embeds negative convexity and is therefore purely buy-and-hold since the potential leverage cannot be monetized before the expiry. The advantage is that the risk is limited to the premium paid, an attractive feature for a cheap short volatility trade, costing less than a third of the equivalent vanilla.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios