No doubt from last two weeks, USDCNY has been spiking higher to the current levels of 6.5954 from the recent lows of 6.4345 levels.

However, it is foreseen that the strength of CNY can be traced to three factors:

The rebound in real GDP, higher commodity prices (which has aided the reflation theme and reduced pressure on the banking system) and higher interest rate differentials.

At the same time in recent months, our proxy of FX positioning data indicates that Chinese corporate USD selling interest has risen noticeably.

To the extent that this positioning adjustment is not yet complete suggests we could still further downside pressure in USDCNY in the near term.

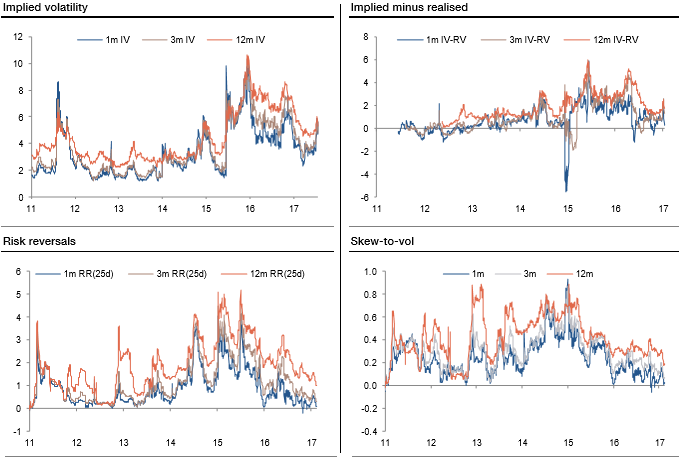

The implied volatility has bounced off the recent lows, the richness of implied versus realized vols has eroded; risk reversals and skew-to-vol are falling, term premiums have compressed while the vol smile has moved higher.

The base case scenario envisions CNH outperforming the forwards to year end.

However, a near term correction might ensue if EUR/EM FX falls or the Party Congress disappoints on the growth front. The PBoC has shown unease about USDCNH being much below 6.50. Topside exposure coupled with selling a downside strike (i.e. bullish seagulls) could be an appropriate structure.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise