- CAD was one of the top performers in global FX throughout 2019. The basis of this outperformance was a relatively resilient domestic economy, especially set against a global backdrop of ongoing cyclical stumbling and disappointment.

- The relative cyclical improvement in Canada allowed for the BoC to buck the trend of global central bank easing that predominated the global monetary landscape, including multiple cuts from the Fed. This significantly improved CAD’s G10 yield advantage.

- The Canadian GDP data is due to be announced today, their economy advance 0.3 percent on quarter in the three months to September 2019, slowing from a 0.9 percent expansion in the previous period. Growth was mainly driven by business investment and household spending. Expressed at an annualized rate, real GDP advanced 1.3 percent in the third quarter, easing from a 3.7 percent growth in the prior period but beating market consensus of 1.2 percent.

Yet the foundation on which CAD outperformed this past year is liable to dissipate into 2020. This is due largely to the fact that the foremost drivers of 2019 cyclical outperformance in Canada were temporary phenomena. Canada will be more vulnerable to a local growth slowdown in 2020, to the detriment of CAD, particularly as we expect a BoC cut in January.

- We look back at the traditional drivers of CAD like rate spreads and posit that they may once again become more relevant with the BoC in play.

- Despite our expectations that Canada loses its cyclical exceptionalism and CAD unwinds some of its outperformance, however, the resulting currency weakness should be only modest, rather than large and broad. But CAD does look particularly vulnerable in risks scenarios (a surging improvement in a global manufacturing capex rebound and a global recession) which creates a CAD-downside barbell effect at the tails.

- And there remain several wildcards to watch, including the fate of the USMCA, ongoing constraints on the local energy sector and potential new leadership at the BoC. We project USDCAD at 1.36 in 1Q’20, grinding to 1.38 by 4Q’20.

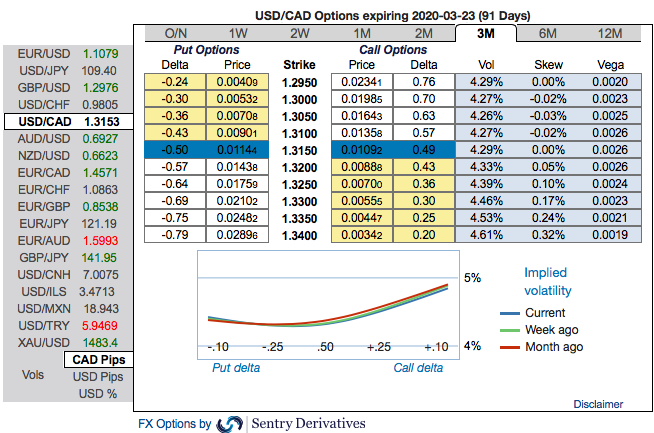

Hence, it is wise to capitalize on USDCAD Interim Dips, and bid short-tenured risk reversals and 3m IVs to optimize hedging strategies.

Options Trades Recommendation: We have advocated diagonal debit call options spreads foreseeing both downswings continuation in the near-terms and the major uptrend.

OTC Outlook: The positively skewed IVs of 3m tenors are also indicating both downside and the upside risks.

While bullish neutral risk reversal numbers substantiate this bullish stance, positive RRs are indicating the hedging setup for the upside risks.

The Execution: USDCAD 3m/1w call spread strategy (strikes 1.29/1.32) for a net debit (we activated when spot reference: 1.3063 levels).

The rationale: Firstly, as you could observe the underlying spot of USDCAD has dipped somewhat in the minor trend below 1.30 level with exhausted bullish sentiments from recent past or so, hedgers’ interests remained intact onto the bullish neutral risk reversals in longer tenors along with shrinking IVs (implied volatilities).

Short calls are most likely to expire worthless, so that the option writer can be rest assured with the initial premiums received.

Secondly, One should understand the prime intricacy of choosing ITM call which is that such options with strike prices close to the price of the underlying spot tend to have the highest risk premium or time-value built into the option prices. This is compared to deep in the money options that have very little risk premium or time-value built into the option price. Courtesy: Sentrix, JPM & Saxobank

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data