The risk-on tone in the commodity markets saw demand for safe haven assets such as gold wane. Nevertheless, gold prices slid $30 - $40 from the last 3-4 days but manage to hold above $1700/oz amid strong support from more monetary easing among the central banks. This is likely to see pullbacks remain shallow and short-lived. Overall, the major price trend has been bullish and we’ve listed some key drivers of this buying stances:

Driving Forces:

1) Investor demand for gold surges as equity volatility fades and rates remain low;

2) Inflation comes in hotter than expected working to boost inflation expectations and further lower real yields;

3) The US dollar weakens dramatically as other countries rebound quicker from the recession;

4) Asian physical buying sharply picks up.

Hedging Strategies:

Capitalizing on all the above fundamental drivers and price trend, we advocate longs in gold via ITM call options as they look to be the best suitable at this juncture.

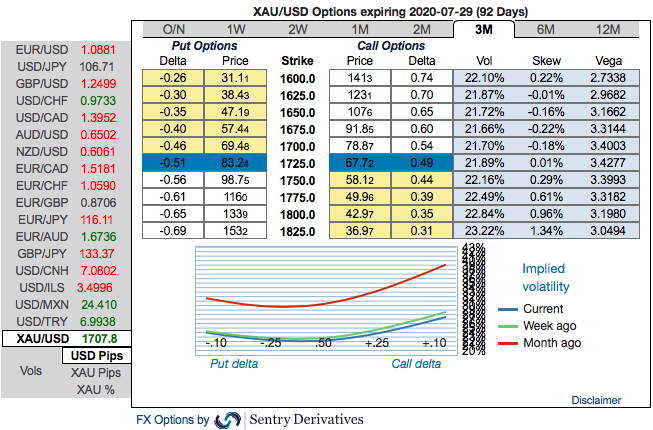

Thus, we still advocate buying 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, we advocated long positions CME gold contracts of April’2020 delivery. We wish to uphold the same strategy by rolling over the contracts for May’2020 deliveries as we could foresee more upside risks and intensified buying interests on safe-haven sentiments amid geopolitical turmoil and the global financial crisis.

The Rationale:

The 3m positive skewness of gold options contracts implies more demand for calls (refer 1st chart). These skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, bids for OTM call strikes up to $1,825 is quite evident that reminds us hedgers’ inclination for the upside risks.

The existing bullish neutral risk reversal setup substantiates the above-mentioned bullish hedging sentiments, these risk reversal (RRs) numbers also indicate the overall upside risk environment (2ndnutshell). Sentry, JPM and Saxo

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms