All NZD traders focus shifted onto RBNZ that is scheduled to announce its monetary policy after the inflation expectations in New Zealand decreased to 2 pct in the Q4’2017 from 2.10 pct in the Q3’2017. While GDT price index likely to be out at 09:00 UTC which is crucial for NZD to be tracked.

Circumstances around tomorrow's RBNZ meeting are the polar opposite:

If the RBNZ remains firmly on hold, as we expect, and the US dollar rises on the delivery of a Fed interest rate rise in December, then NZDUSD should fall to 0.67 by year-end.

NZD has taken a severe beating around the election results, investor pre-positioning is heavily received NZ rates and short NZD, and risks are that the Bank delivers a less-dovish-than-expected statement.

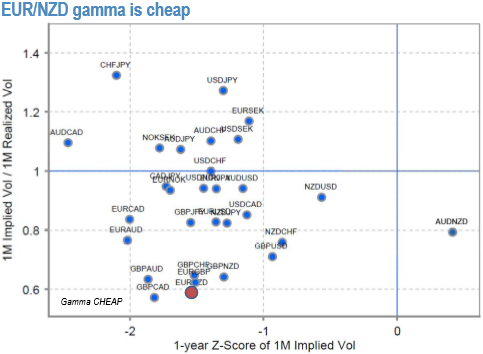

EURNZD is the NZD-cross that screens the best value in gamma to benefit from such a turn of events (refer above chart; 2W ATM 8.1 vs. hourly realized vol 1-wk 9.0, 4-wk 9.5) and is worth holding into the event.

Directional plays for a tactical NZD bounce could take the form of either 1M 1.64 EUR put/NZD call one touch (5X gearing off spot ref. 1.6705) or 1M 1.671.65 put spread (3.5X).

Our RBNZ outlook (on hold throughout 2018) is anchoring short-maturity interest rates and should keep 2yr swap rates in a 2.10% to 2.50% range, as long as inflation remains below 2%. Longer maturity rates will largely follow US rates.

EURNZD spot fx price curve has continued to prolong its bearish swings, tumbled from the highs of 1.7215 to the current 1.6707 levels.

Currency Strength Index: FxWirePro's hourly NZD spot index has flashing at 72 (which is bullish), while hourly EUR spot index was at -91 (bearish) while articulating at 10:54 GMT which is line with our above trade recommendation. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts