Japanese machinery orders on monthly basis ha dramatically spiked over 4%, a massive jump comparatively with previous -3.3%. This signifies the change in the total value of new private-sector purchase orders placed with manufacturers for machines, excluding ships and utilities, which in turn, it reflect in industrial output.

It's a leading indicator of the growing purchase orders signal that manufacturers would considerably increase activity as they work to fill the orders.

Short-term Outlook: The yen continues to underperform most currencies, which is unsurprising given the risk-seeking mood since the US election. NZDJPY’s next upside target is 83.786, which marked a peak in late 2015. The yen’s identity as a risk-averse currency means it has performed badly, even while the recent run of data suggests improving momentum into the end of the year. That improvement should be reflected in another modest lift in the Tankan survey on Wed.

Medium-term outlook: A reluctant to cut BOJ leaves the cross vulnerable to a pullback below 80. With the inflation pulse moving higher helped by the combined sharp rise in commodity prices and the plunge in the yen, there are more reasons for the BoJ to observe from the sidelines.

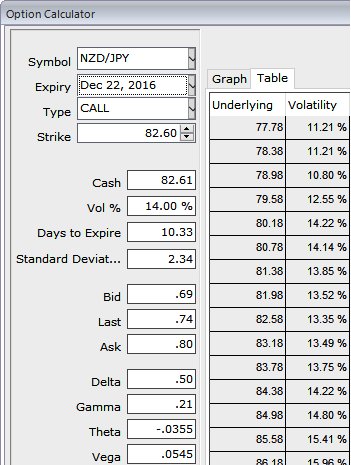

Please be noted that the 10D ATM implied volatilities of NZDJPY is spiking above 14% ahead of BoJ’s monetary policy that is scheduled for next week and followed by Kiwis growth numbers.

As a result, hedgers of this pair are so keen on the turbulence surrounded by this pair, in such circumstances, vega calls are the most conducive for the upside risks, please also be informed that the Vega is the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

For an instance, as you could see the sensitivity tool for 2w NZDJPY ATM call, the Vega of a long (buy) option position is JPY 674 and if IV increases or decreases by 1%, the option’s premium would increase or decrease by JPY 674, respectively.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics