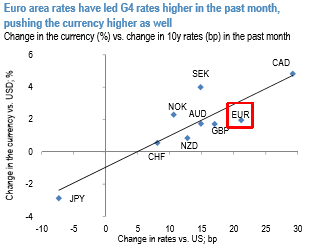

The ECB has signaled a taper announcement for September, while the Fed has been noncommittal on the timing of balance sheet normalization, prompting a Bund-led rise in DM yields which has been EUR supportive (refer above chart).

Well, it’s ECB today..! President Draghi is expected to signal a dovish tightening. Managing the communication will not be easy; at the same time seeking to maintain market expectations that policy normalization is underway, but also avoiding another bond sell-off and euro appreciation.

The base case is for the ECB to announce taper at the September meeting.

While we expect the Fed to announce balance sheet normalization in September as well, the Fed has refrained from sending a firm signal on timing thus far.

The bearish forecast reflected the view that the ECB would be quieter on the taper in the near-term.

Moreover, markets appeared better prepared for an ECB taper than for the onset of Fed balance sheet normalization, as reflected by already-long EUR positions and overshooting valuations vs rates, so any rise in yields was expected to be led by the US.

Hence, a more activist ECB warrants a modest upgrade to the EURUSD forecast, long-standing medium term forecast has been bullish (4Q at 1.15 and 2Q18 at 1.16), while our near-term forecast was bearish (3Q EURUSD target was put at 1.08).

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom