The Black–Scholes model has been accredited as a vivid breakthrough in asset pricing theory. But in applying it to real world options, problems immediately arose, because the volatility that makes an option’s model value consistent with its market price is different for different strike prices: thewell-knownn “volatility smile.” Over time, the smile evolved into a more monotonic, downward-sloping “skew,” and traders became comfortable with the idea of modeling its behavior and describing option market conditions in terms of the level and skew of implied volatilities.

A standard explanation for the skew is that the return distribution is not lognormal; in particular, it generally has a negative third moment (i.e., negative skewness). The similarity of the terms and the (potential) connection between the volatility skew and statistical skewness is one source of confusion. Another is that (unlike skewness) there is no standard measure for the volatility skew.

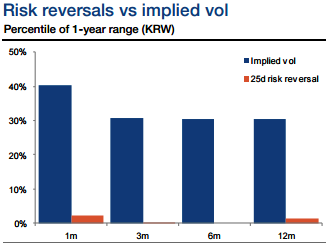

The skewness appears to be very depressed in KRW despite the elevated implied volatilities.

The KRW implied vol (1m to 1y) is in the middle of the 1-year range whereas 25-delta risk reversals are at the very bottom end.

The difference is even more marked in MXN, where implied volatility is at the top end of the 1-year range but risk reversals are close to the low point across the 3m-12m tenors.

As such, risk reversals could be a cheaper way to own volatility or position for tail risks compared to dollar calls.

However, for both MXN and KRW the beta of skew to moves in spot has fallen dramatically in recent years and in the case of MXN has plunged into negative territory.

It is explored that these issues and reviews a number of common skew measures. One significant result is that most of them vary strongly with the level of volatility, making comparisons across different underlying assets or over time difficult. After examining several performance measures, it is suggested that the most useful measure of the volatility skew is the difference between the implied volatilities for a 25 delta put and a 25 delta call, divided by the implied volatility for a 50 delta option.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data