The outcome of the G20 meeting and upcoming economic data globally, including Japanese IP, labour market data, should set the tone for risk assets and the JPY this week.

Perceived policy limits on some major central banks including the BoJ led the market to shift its focus to fiscal stimulus going into the G20.

However, fundamental improvement, particularly in the US and China, will likely be needed to provide any material support for risk assets.

In such an environment of fragile global risk dynamics, we expect CADJPY to decline to 78 in the months to come.

Ahead of Japan's economic data, January industrial production (Monday), January labor market data (Tuesday), and January wages per worker (Friday) will be watched.

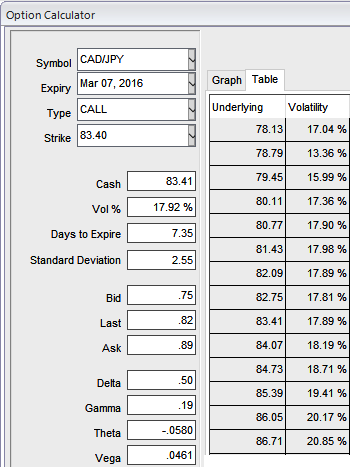

Currently the pair is trading at 83.350 with volatility of ATM contracts spiking higher (at 17.92%), We believe CAD's gain is majorly due to crude's strength. Well, since the pair has no certain direction in either direction, the strategy using OTM instruments are advised.

Hence, the recommendation on a strangle options strategy that consists of buying a put at a lower strike price and buying a call at a higher strike price within the same instrument and expiration.

Strategy: Buy Option Strangle (CADJPY)

Spread ratio: (Long 1:Long 1)

How to execute:

Go long in 1W CADJPY (1%) out of the money -0.39 delta put option. Go long in 1W CADJPY (1%) out of the money -0.37 delta call option.

The strategy fetches an unlimited returns but associated with limited risk to the extent of initiial debit, the strategy that is deployed as the underlying pair would likely experience significant volatility in the near term (17-18%).

FxWirePro: Is Yen baffling FX exposures ahead of Japanese economic events - hedge CAD/JPY via strangles

Monday, February 29, 2016 7:32 AM UTC

Editor's Picks

- Market Data

Most Popular