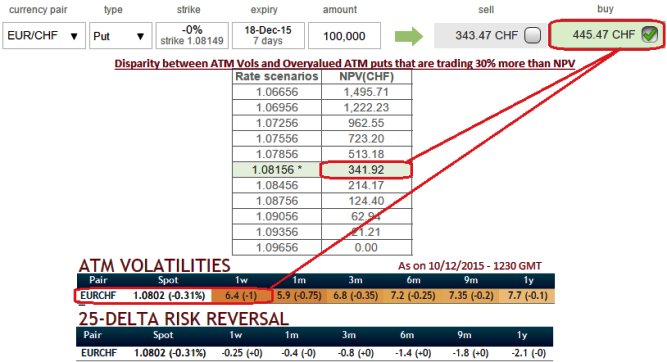

For instance, suppose we've constructed an at the money put option of EURCHF with 1W expiry and with this given maturity has an implied volatility of 6.4% (historically the these vols have never disappointed).

Now the question is should so get stuck overpriced at the money instruments that its delta amounting close to 50% would collapse as the time decay implies progressively.

In a true smile, options with an at-the-money strike are priced with a lower volatility than out-of-the-money and in-the-money volatility strikes. Such market occurrences are observable in the EURCHF FX OTC market.

From the nutshell evidencing risk reversals, 25-delta risk of reversals of EUR/CHF the most expensive pair to be hedged for downside risks after AUDUSD as it indicates puts have been overpriced.

As it showed the highest tendency towards downside hedging activity, alternatively synthetic positions would come into arrest these downrisks.

This expensive options situation could be dealt by shorting spot FX and simultaneously by going long in an at the money call.

The payoff function (Profit/Loss) from this strategy replicate exactly as those from the long put positions.

The two combination create a synthetic long ATM put position with the same risk/reward profile of the overpriced ATM put shown in the diagram.

Have a nice trading time with synthetic EURCHF put position and now is time for weekend party, cheers...!

FxWirePro: Is EUR/CHF hedging cost bothering as disparity exists between IVs and premiums? Replicate hedging with synthetic puts

Friday, December 11, 2015 9:01 AM UTC

Editor's Picks

- Market Data

Most Popular