The euro was remarkably modest yesterday by the fact that the European Commission rejected the Italian budget proposal.

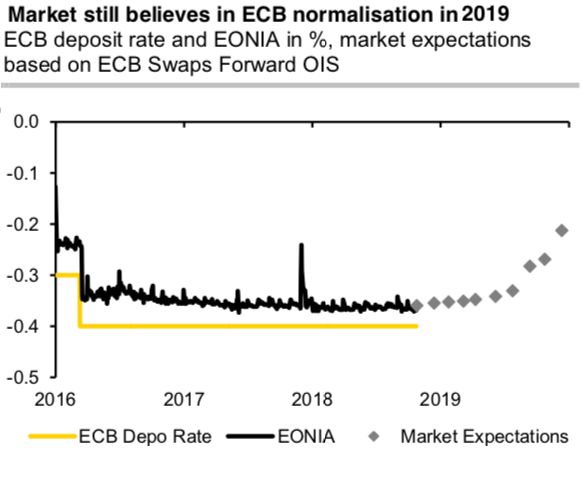

European central bank (ECB) is scheduled for today for its monetary policy, what matters for the euro is whether the ECB will hike interest rates next year as signalled despite the risks associated with the Italian budget or not. Or rather whether the market still believes in a normalisation of European monetary policy or not. That does still seem to be the case as the OIS swaps still price in higher ECB interest rates for year-end 2019 (refer 1stchart). That might explain why the euro is trading at relatively stable levels despite the Italian risks but on the other hand constitutes a considerable downside risk for the single currency should doubt in the sustainability of the ECB’s approach arise. As a result, today’s ECB rate meeting would be particularly well scrutinised.

A probable improvement in rate spreads in the euro’s favour as the ECB delivers rather more tightening than the curve prices. We continue to believe that delivery of early stage ECB tightening should be more impactful for FX than an extension of late-cycle Fed hikes as the market is liable to become more concerned about the longevity of the US cycle if the Fed is confronted with rather more inflation and less growth than this year.

EURJPY OTC updates:

While Euro vol is more sensitive to the ebb and flow of Italy headlines, JPY is more levered to contagion from an escalation of trade tensions. Even absent these risks, there are good reasons for directional yen ownership – structural under-valuation, susceptibility to hawkish BoJ policy tweaks.

Please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 124 levels so that OTM instruments would expire in-the-money.

Most importantly, to substantiate the above indications, rising negative risk reversal numbers of EURJPY across all tenors are also substantiating bearish risks in the long run. While shrinking IVs that are on lower side, is interpreted as conducive for put option writers.

Options Trade Tips (EURJPY):

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Source: sentrix, saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -109 levels (which is bearish), hourly JPY spot index was at 144 (bullish) while articulating at (07:16 GMT). For more details on the index, please refer below weblink:

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady