The US-Chinese trade conflict of the past years has been disappointing and has adverse impact on for the global trade. The relations have reached a new low. It does not seem very likely that the always fragile trade agreement between the two countries will survive the current exchange of blows. At that point we would be returning to protectionist mode (in addition to all the geo-political posing of the two squabblers). So far that has been USD positive. And it still seems likely that if the market will once again focus on the aspect of the trade relations it will instinctively tend towards USD strength.

While there was sufficient fundamental justification for that over the past, that has changed these days. Higher demand for US goods (because US consumers are demanding more domestic goods) would lead to a shift in real exchange rates in favor of the greenback and thus (if the inflationary effect does not eat into it too much) to a stronger dollar. That was the story in 2018/19. At present we are in a different environment though. As a result of corona, demand in the US and globally is collapsing and is moving towards other groups of goods. It seems questionable whether in this storm of demand swings import tariffs would still be relevant. So there is currently no fundamental justification for interpreting a renewed trade conflict in a USD positive manner.

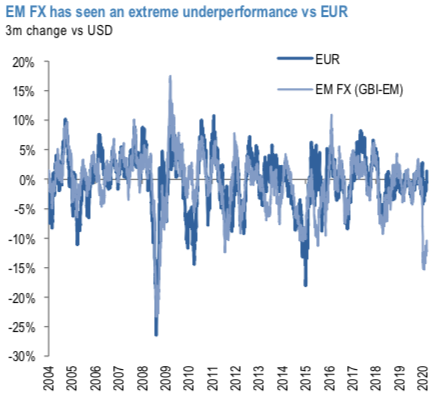

EM FX likely to be in for some short-term reprieve. EM FX has continued to be a laggard, for good reasons, but is seeing a pocket of performance that we do not think is worth fading yet. The underperformance versus EUR is a good illustration (refer 1st chart). Near-term risks come primarily from: a) The fact that EM countries themselves are opening up even as they are not yet successfully through their first wave of COVID-19, b) The US- China tensions increasing. To hedge US-China tensions we moved UW CNY in our model portfolio and have added an outright bearish trade via CNH options. An early opening may allow near-term economic activity to improve, supporting market sentiment, but stores up risks for later as economies may continue to see ongoing disruptions due to virus flare-ups.

OTC Outlook & Hedging Strategy:

Please be informed that the positively skewed USDCNH IVs of 6m tenors still indicate the upside risks, they are still bids for OTM call strikes up to 7.56 levels (refer 2nd chart).

At this juncture, we uphold our shorts in CNH on hedging grounds via 6-month (7.00/7.56) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. Courtesy: Sentry, JPM & Commerzbank

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?