The ECB rhetoric has reduced expectation of an early ECB lift off but the EONIA market is still pricing 10bp of tightening by Jun18.

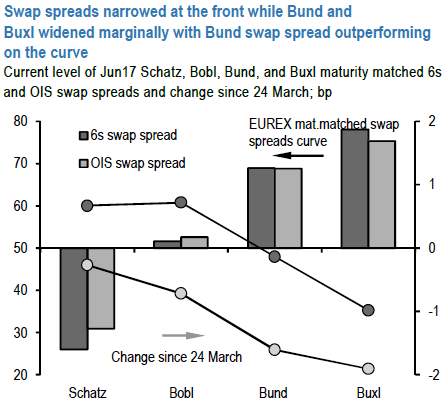

Over the past week, swap spreads narrowed at the front while Bund and Buxl widened marginally with Bund swap spread outperforming on the curve (refer above diagram).

Flows were anecdotally light with some modest swapped issuance receiving activity and unwinding of some French hedges.

Swap spreads volatility has declined across the curve but still remains close to the highs of the past one year for front and intermediate sectors (refer above diagram).

We note that over the past few months the historical volatility of swap spreads has shifted across the maturity curve. Around the end of last year swap spreads were much more volatile at the long and ultra-long end of the curve.

However, as the ECB announced to start buying bonds below the depo floor, the scarcity argument and the repo funding pressures shifted more to the front end of the curve. These factors, combined with concerns around redenomination risk ahead of the French election, drove Schatz swap spread volatility higher across the curve.

We believe front end swap spreads will remain more volatile and that is the reason why, given our swap spread narrowing bias, we expect a steeper swap spread curve.

Valuation arguments are neutral for Bund swap spread, which is now trading broadly fair in our long-term fair value model, after adjusting for sovereign QE (refer above diagram). We attribute the recent correction from expensive levels of the past few weeks to receding perceived political risk in French elections.

Bullish hedges: favor 2s/10s/30s bull belly richness and keep 1Y swap/Bobl conditional weighted bull flattener.

Bund swap spread is broadly fair in our long-term fair value model, whereas Schatz swap spread is expensive vs. funding rate and 10Y France/Germany spread.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks