In this write how and why selling a covered put in AUD/JPY is emphasized. The underlying pair has been amongst the worst performing G10 pairs since before the US wage data last week (-3.1%). Furthermore, AUD has been by far and away the worst performing G10 currency following major vol events in equities over the past 15 years (average losses are double those of the next worst, NZD, albeit this result is obviously distorted by the GFC).

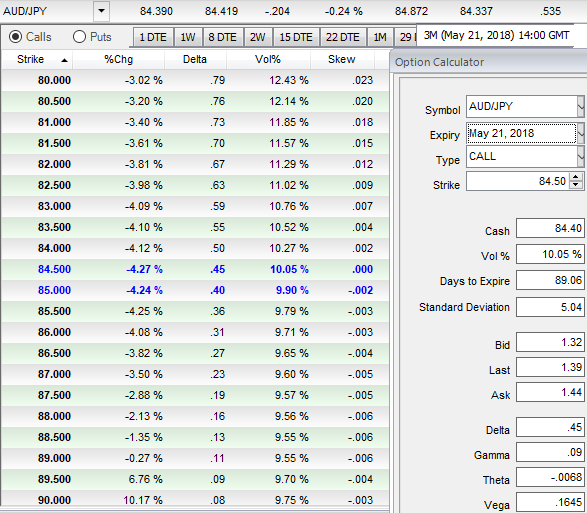

AUDJPY vols of 3m tenors are also at the decent side (10.05%) which is conducive for option holders, while skews have positively stretched on OTM put with attractive gammas, this Options Greek is the rate of change of the Delta with respect to the movement of the rate in the underlying market.

AUDJPY is consequently a reasonable pick to position for even a modest extension of the unsettled risk market conditions which erupted this week, especially as these percolate through to other markets, including commodities.

We are of course somewhat late to the sell-off in spot terms, but then again vols have spiked and the risk reversal has jumped for AUDJPY downside, and we can monetize this via a covered put structure in which we sell a 1-mo 25D put against a short cash position.

The vol on 1m 25D AUDJPY puts has nearly doubled since the start of the year (13.5% versus 7%) and is now 2.5 vol points richer than 1m realized vol. AUDJPY has dropped 3.25% this month; the covered put gives us exposure to another 3.25% while taking in 0.56% in premium.

Consequently, stay short in AUDJPY at 85.19, stop at 87.11. Sell a 1m AUDJPY put, strike 82.50 for 0.54%.

Currency Strength Index: FxWirePro's hourly AUD spot index has turned into 8 (which is neutral), while hourly JPY spot index was at shy above -15 (mildly bearish) while articulating (at 12:22 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data