The instrument of monetary policy in Singapore is the nominal effective exchange rate (NEER) rather than a market interest rate. This is because of the small and open nature of the economy with free capital movement. The Monetary Authority of Singapore (MAS) is the regulator and the central bank.

Its objective is price stability and the policy framework comprises four components, including:

1) The policy bias of the NEER; 2) This is the mid-point of the SGD NEER around which it is allowed to deviate. It was last adjusted in April 2011 where it was re-centred higher to just below the prevailing level of the time. In other words, an upward shift represents a one-off policy tightening and vice versa.

3) The bandwidth around centre the NEER can fluctuate; and 4) basket of key currencies of its major trading partners. To tighten policy, MAS appreciates the NEER and vice versa. It has kept policy neutral since April-2016 given tame inflation.

As of today, we estimate the SGD NEER is at +0.4% above the estimated mid-point for current spot USDSGD at 1.4020, USDCNY at 6.8950, EURUSD at 1.0620, and USDMYR at 4.4310. We estimate the +/-2% range for the SGD NEER corresponds to USDSGD between 1.3800-1.4360, with the mid-point at 1.4070, ceteris paribus (all things equal).

Option Trade Recommendation:

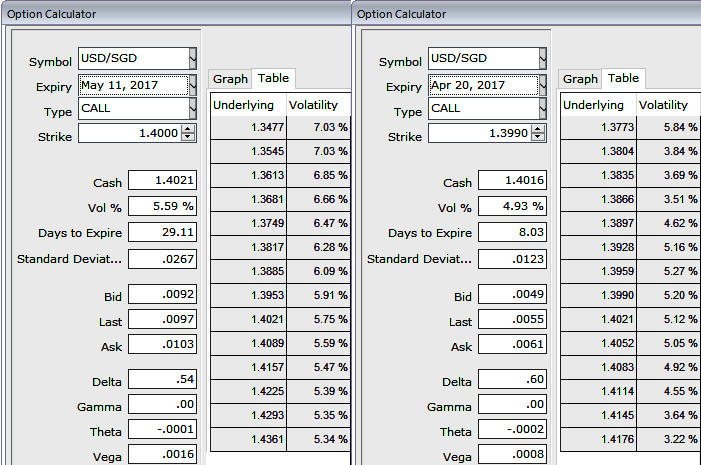

Please be noted that the ATM IVs are tepid despite monetary policy, creeping up at 4.93% and a tad below 5.6% for 1w and 1m tenors respectively. An option writer wants IV to fade away so the premium also shrinks away. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive. Hence, these lower yielding IVs are useful for writers.

Well, amid bearish risky environment, on a hedging perspective the foreign trader who are considerably expect slumps, debit put spreads are advocated as the selling indications are piling up on weekly technical graphs. So buying In-The-Money Puts and to reduce the cost of hedging by financing this long position, selling an Out-Of-The-Money put option is recommended.

So, here goes the strategy, Debit Put Spread = Go long 1M ATM -0.49 delta Put + Short 1W (1%) OTM Put with lower Strike Price with net delta should be at -0.40.

For a net debit bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices