The Federal Reserve last night maintained interest rates unchanged at 1-1.25%, as widely anticipated. The press statement was largely unchanged: it sounded a little more upbeat about recent economic developments, while still acknowledging some concerns about low inflation. A December rate rise is still likely, even though it was not explicitly signaled. Separately, President Trump is due to announce the next Fed Chair at 19:00GMT. His pick is expected to be Jerome Powell, who is a current Fed Governor, and would represent continuity in monetary policy. Powell is scheduled to speak at an event today.

BoE to pull the trigger: The BoE MPC is all set meet shortly and will probably raise rates by 25bps, marking the first rate hike in a decade. However, we question whether the MPC will have the opportunity to push through further rate hikes. A dovish hike (interpreted by markets as ‘one-and-done’) is likely to be neutral for Gilts and sterling.

We do not expect it to be a unanimous vote but the Bank of England MPC is expected to hike rates for the first time since 2007 at 12 PM (GMT) today. The rhetoric in the minutes has become more and more hawkish and the balance of other recent communications from members has reinforced the message that the committee is becoming increasingly uncomfortable with the current stance of monetary policy.

Firm growth, above target and still rising CPI (3% YoY in September) and a low unemployment rate makes the economic case for a hike. In addition, the market expects it, suggesting more disruption from a decision to hold than to hike.

As briefly alluded to earlier, the near complete pricing-in of next week’s BoE hike and the risk of dovish commentary in the wake of less-than-stellar cyclical dataflow leaves the pound vulnerable to an EUR-like drawdown.

Sterling isn’t a currency for high conviction capital commitment for most investors in light of the complicated twists and turns in monetary policy and politics, hence we suggest a low premium alternative of buying GBPJPY – USDJPY put switches to create synthetic short GBPUSD exposure.

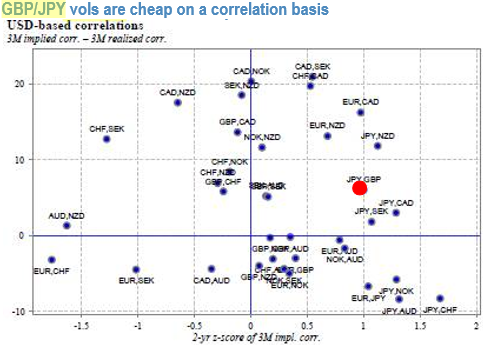

The RV rationale is that GBPJPY vols are cheap on a correlation basis (refer above diagram); the vol spread is a proxy for the selling the full USD-GBP-JPY correlation triangle.

Long GBP put/JPY call – USD put/JPY call 7-wk (15Dec17) 30D strike option spreads (strikes 146.50 and 112 off spot ref: 151.264 and 114.092) costs 12bp JPY in premium (equal JPY notionals/leg), much lower than the 115 bp GBP premium for an equivalent strike GBP put/USD call despite fairly conservative strike selection on the short USDJPY leg.

Currency Strength Index: Ahead of above stated BoE’s significant data event, FxWirePro's hourly GBP spot index is shy above positive -3 (which is neutral), while hourly JPY spot index was at -127 (extremely bearish), and USD at -7 (neutral) while articulating at 08:51 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis