Yesterday, the Sterling dropped vigorously after the announcement that the UK parliament would be prorogued in the second week of September until the 14th October. GBPJPY is one such pair that showed renewed bearish traction amid lingering geopolitical turmoil. The pair has shown interim rallies from the lows of 126.541 to the recent highs of 130.698 levels. Thereafter, slid back below 130 region, currently, hovering at 129.700 (i.e. 7-DMAs, refer above price chart).

The announcement gives parliamentary opponents of a ‘no-deal’ Brexit only a small window to block such an exit on 31st October. Market will now look for opposition parties’ reactions when parliament returns next week. Let’s now quickly glance through GBPJPY OTC outlook and options strategy.

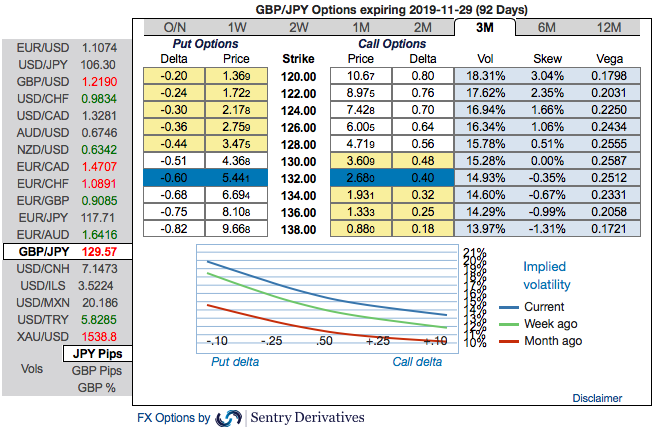

OTC outlook and Options Strategy: Amid huge turbulence of Brexit surface, most importantly, note that IVs of this pair display the highest number among entire G7 FX universe.

Please also be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 120 levels (refer above nutshell evidencing IV skews).

Accordingly, put ratio back spreads (PRBS)are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on interim price rallies that seem momentary and bidding theta shorts in short run, on the flip side, 3m skews encourage delta longs. Both put together can optimally utilize prevailing condition and set up an ideal hedge.

The execution: Capitalizing on any minor upswings , we advocate shorting 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or slides mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options (spot reference: 129.600 levels).

The rationale for PRBS: Well, the traders tend to perceive these trades as a bear strategy, because it deploys more puts. But actually, it is a volatility strategy.

Hence, entering the position when implied volatility is high and anticipating for the inevitable adjustment is a wise thing, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options, and one that makes a lot of sense.

Every underlying move towards the ITM territory increases the Vega, Gamma, and Delta which boosts premium. As you could observe spot GBPJPY keeps dipping, these delta longs would become in the money, while these derivatives instruments target further bearishness of this pair. While the recent rallies seem to be deceptive that could be conducive for the OTM put options writers. Courtesy: Sentrix & JPM

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures