The global “trade war” has become almost a euphemism for what is happening between the US and China at this juncture.

The Turkish lira extended its momentary rally again on Friday on the strong Q1 GDP data. The GDP data were in line with expectations, but the print will still prompt upward forecast revisions, hence the data were supportive to some extent. Nevertheless, the GDP break-down was not all that encouraging.

More than these data, we reckon:

1) The sharp decline in the oil price,

2) The continued slide in global bond yields, and

3) Noticeable increase in foreign tourist arrivals during April (data published Friday) were all major boosts for the lira on Friday.

Falling interest rates help EM assets generally; but the oil price and tourist arrivals specifically help Turkey’s current- account – if those trends continue, that would bring fundamental improvement to the macroeconomic situation as well, hence the near-term market reaction is consistent.

The key question is: how strong and how long will these trends turn out to be. Our apprehensions regarding the underlying policy outlook remain unchanged. Large external debt rollover requirements are a key source of TRY pressure. Additionally, with renewed political uncertainty the local dollarization trend could resume. The central bank has so far announced technical measures, which may temporarily slow FX weakness but are unlikely to reverse recent trends, in our view.

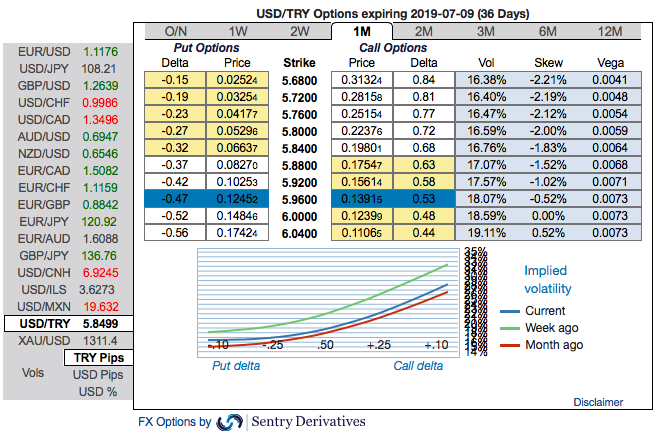

Trade tips: Contemplating prevailing price dips, we reckon that it has been a rosy time for deploying longs with a better entry level, on hedging grounds 3m USDTRY debit call spreads are advocated with a view to arresting upside risks. Initiate 3m 5.30/6.54 call spreads at net debit. Thereby, one can achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

The rationale for the trading: Please observe that the above technical chart is also clearly indicating the further upside risks.

It seems that hedgers of TRY are positioned for the upside risks on the above fundamental factors. The positively skewed IVs of 1m tenors are bidding for OTM calls strikes up to 6.04 levels.

IVs of this underlying pair is also on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is conducive for the option holder, just for an intuition that the higher likelihood of the market ‘swinging’ in holder’s favor. Please also be noted short-dated options are less sensitive to IV, while long-dated is more sensitive. Courtesy: Sentry, Commerzbank & Tradingview.com

Currency strength index: FxWirePro's hourly EUR spot index is inching towards 49 levels (which is mildly bullish), while hourly USD spot index was at -37 (mildly bearish), while articulating (at 13:24 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch