Apart from currencies battered by idiosyncratic factors (TRY, MXN, GBP), the yen is the only other USD-major where owning vega has been profitable YTD. This owes primarily to USDJPY’s pronounced sensitivity to high frequency shifts in the US policy narrative since the November elections, both on the upside during phases of optimism around a muscular fiscal package and the attendant rise in Treasury yields, as well as on the downside when anxiety mounted around the Trump administration’s trade, tax and FX policy.

The latter does not surprise as yen appreciation and higher volatility during risk aversion is almost an axiom in currency markets; it is on the weaker yen side of the spot distribution that a new, higher volatility dynamic has emerged as US bond markets tantalizingly flirt with the prospect of breaking out of the post-GFC rate repression shackles.

In addition to realized spot gyrations, the latter also explains why perceived tails of potential USDJPY spot outcomes this year are fat in our view. The current dispersion of consensus Q4’17 USDJPY forecasts on Bloomberg is a hefty 25% (min-max spread of 99 –128); the high/low range implied from US interest rates is even larger if one attaches conservative FX vs. rates betas to the 0.70 –2.40 Year’17 forecast range on 2-yr Treasury yields.

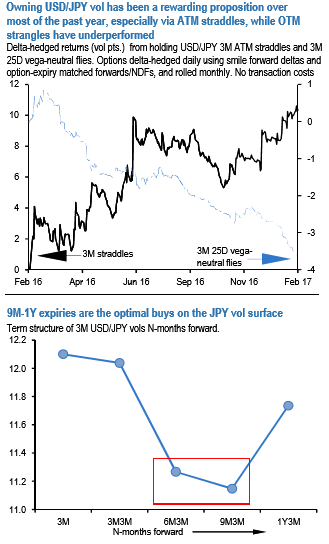

Holders of yen vol have benefitted from this spot/vol asymmetry, especially via straddles as high-frequency yen gyrations have tended to be concentrated within local spot ranges; strangles have been comparatively less effective as outsized gap moves in spot that reward deep OTM strikes have been hard to come by, reflected in persistent underperformance of flies (refer above chart).

Against this backdrop, tactical event risks around the Abe Trump summit on February 10-11 and speculation around the longevity of the BoJ’s yield-curve control policy following the rise in JGB yields to well above the zero targets further strengthen the case for buying yen vol.

Our macro team entered a short USDJPY cash position in anticipation of potential political pressure that could catalyze deeper yen appreciation, which in any case is the medium-term house view in a world of the trade conflict.

The icing on the cake is that entry levels into yen vega longs have improved over the past month as vols have cooled (both 3M and 1Y ATMs 0.8), and the cost-of-carry on long option positions is bearable with the vol curve mildly inverted (1Y –1M -0.6) and recent realized vols running apace with front-end implieds. 9M -1Y ATMs are the optimal points to buy along the curve given the shape of the forward vol term structure (refer above chart).

We are already long USDJPY vol in our model portfolio via an existing EURUSD + USDJPY EURJPY 6M correlation triangle, and bucket by entering outright 1Y straddles this week.

While investors desiring a management lite version of the same could consider 1Y vol swaps or 6M6M forward volatility (FVAs) as alternative expressions.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand