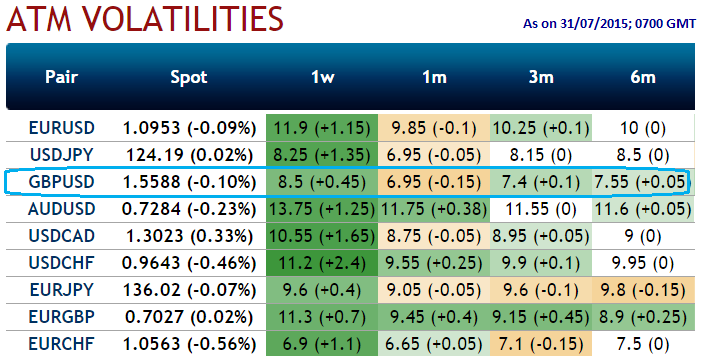

Since the GBPUSD's implied volatility is perceived to be comparatively minimal among the major currency basket (experienced at 8.5%) and expected to be lower over the period of time as shown in the nutshell, so contemplating this IV one can execute the calendar straddle as follows, It is quite simple as we go shorts on ATM calls and ATM puts using near month contracts while adding longs on far month ATM calls and ATM puts again from the rapid time decay of the near term options sold. It is likely to fetch certain returns to the extent of premiums received but offers limited risk to the options trader who thinks that the GBP/USD exchange price will experience very little volatility in the near term.

So streaks of questions arise how to monitor these multiple legs strategy, similar to all calendar spreads it is very essential to decide on which follow-up action to take when the near-term contracts expire. This is exclussively dependant on the revised outlook of the GBP/USD at that time ahead of Fed's rate policy. Should the options trader reckons that the underlying volatility will likely remain low, then another calendar straddle by writing another near term straddle is advisible.

If he thinks that the volatility is likely to increase significantly, he may wish to hold on to the long term straddle to profit from any large price movement that may occur. However, if the options trader is unsure of what to expect of the underlying, it may be best to take profit (or loss) and move on to evaluate other trading possibilities.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate