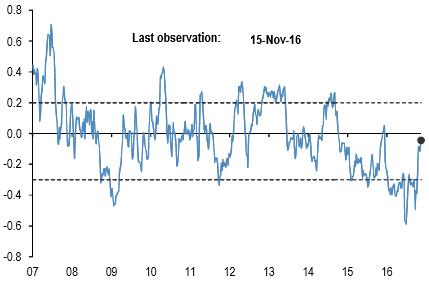

The difference between net spec positions on risky & safe currencies

Net spec position is calculated in USD across 5 "risky" and 3 "safe" currencies (safe currencies also include Gold).

These positions are then scaled by open interest and we take an average of "risky" and "safe" assets to create two series.

The above chart is then the simply the difference between the "risky" and "safe" series. The final series shown in the chart is demeaned using data since 2006. The risky currencies are: AUD, NZD, CAD, RUB, MXN, and BRL. The safe currencies are: JPY, CHF, and Gold.

You could probably understand why we are stating this by referring the above nutshell evidencing delta risk reversal. JPY, CHF and XAU crosses against the dollar have negative flashes which would mean that these currencies have safe proportions in hedging arrangements, whereas rest dollar crosses show positive risk reversal which means that bearish pressures are intensifying in these counterparts of the dollar.

Net spec positions are the number of long contracts minus the number of short using CFTC futures only data. This net position is then converted to a USD amount by multiplying by the contract size and then the corresponding futures price.

To proxy for speculative investors, for commodity positions we use the managed money category, for equity positions we use Leveraged funds and Asset managers, whereas other assets use the legacy non-commercial category.

We then scale the net positions by open interest. The chart shows the z-score of these net positions, i.e. the current net position divided by the open interest, minus the average over the whole sample divided by the standard deviation of the weekly positions over the whole sample.

US rate is a duration-weighted composite of the individual UST series excluding the Eurodollar contract. UK ICE Brent positions are with one week lag. The sample starts on the 13th of June 2006.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts