In line with the September PMIs, today’s Bank of France business sentiment survey indicated a loss of momentum at the end of Q3, particularly in the manufacturing sector.

Indeed, the headline index also dropped 3pts to 96, reflecting a drop in production that month, particularly in the manufacturing of machinery and electronic equipment. Nevertheless, with order books having improved slightly manufacturers anticipated a pickup in production in October.

And on average over the third quarter as a whole, the manufacturing sentiment index was only ½pt lower than the Q2 average. In the survey, services firms also suggested that activity slowed slightly in September, although the headline index at 99 remained close to the long-run average and still left the quarterly index unchanged from Q2 at 100. And construction firms were a touch more upbeat about recent conditions in the sector, with the respective headline index rising 1pt to 105, a four-month high.

In addition, the orders received by German industry in August fell by 0.6% compared to the previous month, which is more than expected. Leading indicators such as Ifo expectations also indicate that the downward trend in German industry is likely to continue.

Overall, today’s survey aligned with the messages from the INSEE and PMIs, that there was neither substantive improvement nor notable deterioration in economic conditions in Q3. As such, the Bank of France continued to assess the survey to be consistent with GDP growth of 0.3%Q/Q in Q3, which would be unchanged from growth in the first two quarters of the year and is fully in line with our own forecast. Contemplating all these underlying factors, euro seems to be edgy on increasingly chronic underperformance of the Euro area economy. We could foresee reasonably bearish risks for EURJPY amid such backdrops.

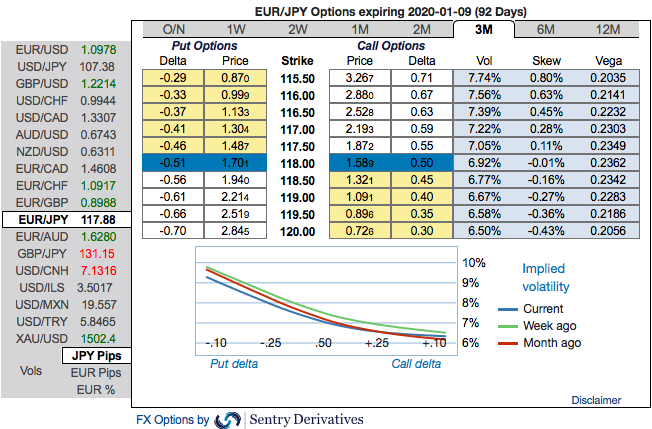

OTC outlook (EURJPY): We noted in our recent post that the positively skewed IVs of 3m tenors signifying the hedging interests for the downside risks. There is no much change in our hedging outlook, as the bids for OTM puts expect that the underlying spot FX likely to show further dips so that OTM instruments would expire in-the-money.

Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is noteworthy size in the forex options market that can stimulate on the underlying forex spot rate.

Options Strategy: Contemplating above factors, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Short hedge: Alternatively, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips. since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for September month deliveries. Source: Sentrix, Saxo & Commerzbank

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation