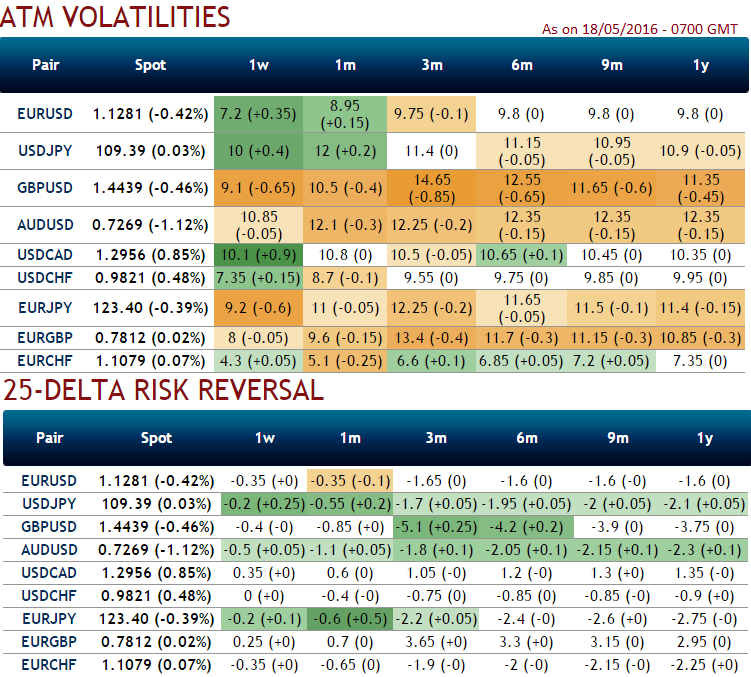

At spot FX flashes of EURUSD at 1.4525 please be informed that the delta risk reversal for contracts of 1W and 1M expiries have shown reducing bearish sentiments, but in long term (3M-1Y) put contracts are still on higher demand.

The long term investors seems to have shrugged off the short term bullish sentiments in EURUSD OTC FX markets as you can make out from the nutshell showing EURUSD’s implied volatilities of 1M at the money contracts are shrunk away, the least among G7 currency space, below 8%.

We recommend that companies’ to hedge dollar denominated expenses up to next three months from now via FX forwards.

This would protect against any short-term EUR/USD decline prompted by a faster-than-expected increase in US rates and yields and/or a Brexit.

Also, FX forwards would shelter a premium on the forward exchange rate relative to the spot rate due to the EURUSD yield spread.

For USD-denominated expenses on 3M-12M horizons, we recommend hedging EURUSD exchange rate risks via FX options as OTC markets are being highly active during this period that maintain a profit potential in the event of an increase in EUR/USD, while also securing a worst case exchange rate.

More specifically, we recommend hedging USD-denominated expenses via knock-in forwards with window barriers, with the barrier open for one month before each maturity date. A 9M structure including nine independent payments (the first on 19 August 2016) could, for example, be entered at zero cost (indicative pricing, spot ref. 1.1350) and would allow advantage to be taken of any increase in EUR/USD up to 1.2630 (an increase of just over 11% relative to current spot).

Meanwhile, the strategy would secure a guaranteed minimum exchange rate of 1.1000, leaving protection against any EUR/USD fall of just over 3%. As such, this strategy would enable advantage to be taken of a significant increase in EUR/USD, while also guaranteeing a favourable selling rate over the entire strategy period.

The euro slid to three-week lows against the broadly stronger dollar on Wednesday on the prospect of higher U.S. interest rates, as investors looked ahead to minutes from the Federal Reserve’s April meeting later in the day. EURUSD was down 0.35% at 1.1256, the weakest level since April 26.

Overall, we thus project EUR/USD to shift in the 1.1100 to 1.1450 range on a 3M horizon. It is still quite unlikely that EUR/USD would drop to a new record low during the current economic cycle – even in the event of Brexit. Our EUR/USD forecast is 1.12 on both a 2W and a 1M horizon.