Since, we could foresee risk bias on both sides, as the long term downtrend has given trend reversal signal or it is just puzzling.

Well, technically although this pair has tested supports minor supports at 0.6626 levels and showing considerable price bounces, bearish pressures at 0.6699 can't be disregarded for short term trend.

On the contrary, a potential breach of 0.6699 would determine short term rallies and 0.6826 mark as barrier for long term trend reversal.

On RBNZ rate cut perspectives, despite calls from RBNZ Wheeler, NZD continues to trade well-in-trade-weighted terms, it is at a 2m high.

The RBNZ may have brought in surprising cut rates but it also hinted the easing cycle may be over and that turned what ordinarily would be a currency negative event (a 25bps cut that was only 60% priced in ahead of the meeting) into something currency-positive.

NZD/USD at 0.6626, despite RBNZ surprises cut the strength is considerable that offers now at 0.67 and bids at 0.6826 levels. Stops below 0.6675/0.6640.

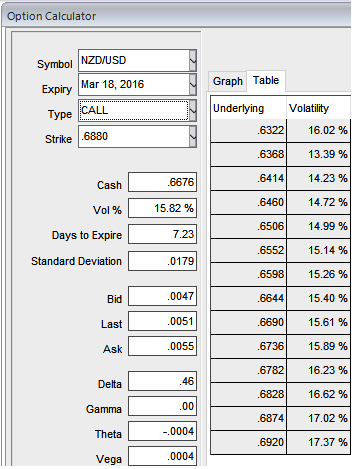

The implied volatility of 1W NZD/USD ATM call options are at 15.82%.

Hedging Framework:

Spread ratio: (Long 1: Long 1: Short 1)

With trend puzzling on either direction we like to advocate 3-Way Options straddle versus call option.

How to execute:

Go long in NZD/USD 3M At the money delta put, Go long 6M at the money delta call and simultaneously, Short 1M (1.5%) out of the money call with positive theta.

FxWirePro: Hedge NZD/USD's risks via 3 way straddles versus call

Friday, March 11, 2016 9:56 AM UTC

Editor's Picks

- Market Data

Most Popular