USDCNY started the Asian trading session with a smooth tone and the news that the top trade negotiators resumed talk has somewhat warmed up the market sentiment. As a necessary preparation for the Trump-Xi meeting scheduled for this weekend, the chief negotiators agreed over the phone to keep the communication, which opens the door for further trade talks.

However, another piece of news is seemingly more damaging as three Chinese banks are reportedly involved in a probe on North Korea sanctions which could result in further penalties from the US. As a result, CNY weakened on the back of this destructive news, which reflects the fragile US-China relationship although the trade talks are still on the cards after the Trump-Xi summit.

However, as the market has very low expectations regarding the talks at this juncture, any bad news will probably have only a short-lived market impact.

On a broader perspective, a breakthrough to the psychologically important level of 7.00 could shift domestic perceptions around depreciation pressures and fuel capital outflow pressures. This would pressure FX reserves, domestic liquidity, and local interest rates, all else equal. Such a scenario is something the authorities may well be keen to avoid in the short term. Related to this point is the fact a sharply weaker CNY may undermine future negotiations. For instance, a rapid depreciation through 7.00 could prompt US retaliation on the remaining goods that aren’t subject to tariffs at the moment.

Emerging Asian currencies are vigilant against possible weakness in the Chinese yuan. US President Donald Trump notified Chinese President Xi Jinping that a 25% tariff would be levied on the remainder USD325bn worth of Chinese goods if both leaders fail to meet at the G20 Summit on June 28-29. The 12M NDF outright for USDCNY has, for the first time since last November, started to test the psychologically critical 7 levels again.

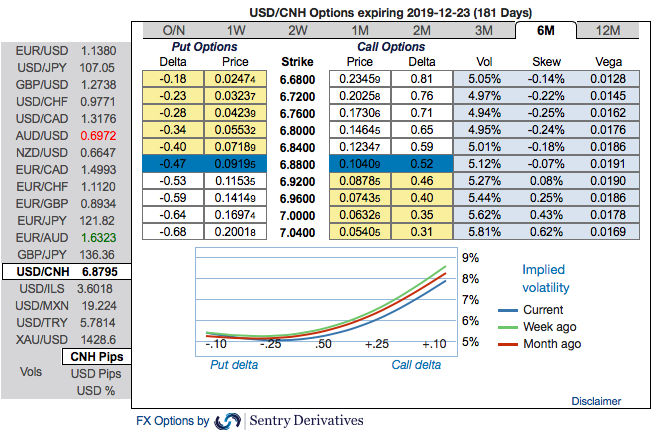

OTC FX updates: You could easily make out that the positively skewed 3m IVs of USDCNH has been stretched out on either side, whereas 6m skews are indicating upside risks. Bids for OTM call strikes up to 7.04 levels are observed (refer above nutshell). This is interpreted as the hedgers’ sentiments are inclined towards upside risks than the downside.

Trade tips: Buy 6M 40D (6.76 strike) USD calls/CNH puts vs sell 1M OTM calls of 7.10 (Spot reference: 6.8786). Courtesy: Sentrix, JPM & Commerzbank

Currency Strength Index: FxWirePro's hourly CNY spot index is inching towards 160 levels (which is highly bullish), USD is at -135 (highly bearish) while articulating (at 13:55 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts