Pound recovers on ‘hawkish’ Bank of England, it is quite easy to cook up story like this. Is it wise enough to give all credits BoE? Well, in FX market, it is not the isolated news that drives the action, we would rather look at in a heterogamous perspective.

No doubt, the pound has experienced an acceleration in its uptrend against the US dollar, but in the recent weeks itself which was prior to the BoE event.

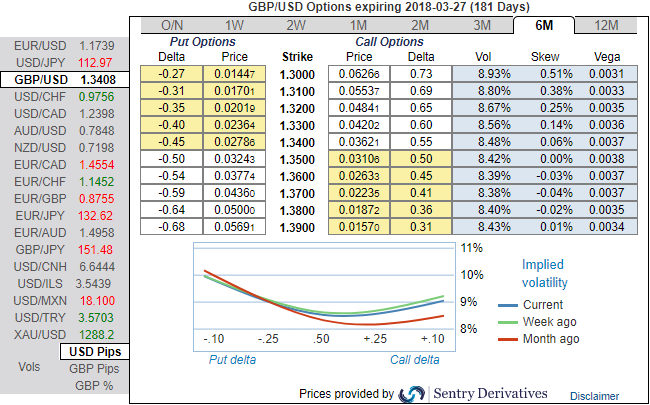

But not disregarding the central bank’s event risk, OTC markets have priced in this news in 1w-1m tenors. Please be noted that the significant shift in risk reversal to positive side as rallies hit the new year-to-date high above 1.3650 at one stage. This was led by a re-pricing of expectations of UK Bank Rate, following ‘hawkish’ minutes from September’s Bank of England (BoE) policy meeting and upbeat comments from Monetary Policy Committee (MPC) members, which caught the market off-guard.

With Brexit negotiations dragging on, we still see downside risks for the pound.

Only once the future relationship between the UK and the EU starts to gain shape do we see room for a sustained recovery of GBP exchange rates.

Even with uncertainty over Brexit negotiations ongoing, the pound gained in September. This was due to the Bank of England (BoE) signaling a rate hike on the back of increasing (core) inflation.

Initially, however, we only see scope for one rate hike, which is unlikely to be sufficient to send the pound higher on a sustainable basis.

Therefore, the downside risks to the pound will predominate for now. Both the ECB and the Fed are likely to tighten monetary policy before year-end, which is why the pound looks set to lose both against the EUR and the USD. This is also evident if you look into the positively skewed implied volatility of GBPUSD of 6-months tenors that is indicating hedgers' interests in downside risks upto 1.30 levels.

Finally, on the flip side, any cyclical/Fed repricing needs to be considered in context of what is happening in the rest of-world where in some places the recent or potential repricing might be more significant. For example, as mentioned earlier, the more significant policy repricing in the past two weeks was in the UK, and the resulting 3% rise in GBPUSD certainly was a drag on the magnitude the USD index was able to rise on its own policy repricing, and explains why the DXY index (where GBP has a 12% weight) failed to advance in the past two weeks in spite of the Fed story.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data