We’ve recently seen that the Australia’s trade deficit widened sharply to AUD3.2bn in June from a revised AUD2.4bn in May.

Even though the Aussie exporters have the proper financial arrangements placed with letters of credit, collections or open accounts that are more a balanced payment method in terms of risk issues, but each LC party bears some amount of FX risks (especially in term LCs), so do you think advising/bene bank or confirming bank carries such risks on their shoulder? Answer alerts you from saving your FX portfolio.

The documents under consignment are delivered to buyer/importer only after collecting payment of goods by buyer’s bank.

As per D.A terms, once the shipping documents along with bills of exchange received by the buyer’s bank, the buyer is informed to accept documents by buyer’s bank. The buyer accepts documents by signing bills of exchange sent by the exporter, agreeing to pay the value of goods shipped as per agreed period of time. (say, 30 days from the date of bill of lading, 60 days from the date of bill of lading or 90 days from the date of bill of lading).

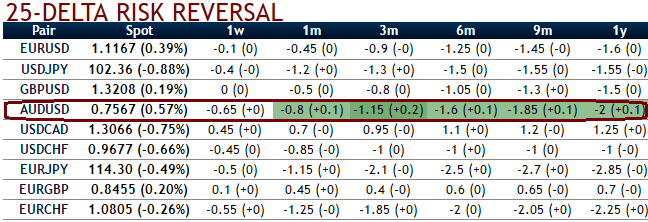

Well, in this span of time AUD is anticipated to be depreciated, thereby, the foreign trader in Australia is more likely to curtail his receivables. To substantiate this stance, AUD FX OTC markets signify these risk both shorter and longer time frames, as in AUD is most likely to deteriorate in its value against the dollar.

Thus, glancing over the risk reversal tool it is advisable to stay hedged moderately in AUDUSD exposures if it not aggressively.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?