Gold attempts to bounce back above $1,400/oz level from the last 2-3 days, when the surprisingly positive US nonfarm payroll numbers sparked some rethink about US rate cuts. It has now been 9 of 10 sessions that gold stayed above the critical $1,400/oz level, lending strength to the support of that level.

Data this morning also showed China adding to its reserves for a sixth consecutive month (since they started disclosing again in December).

While gold holdings as part of its foreign reserves may pale in comparison with the likes of the US, Germany or even Italy, China has been actively buffering up its gold reserves in the past decade. Only Russia has added more in the same time period. Expect the gold purchases by Russia and China to continue in the medium-term, with upside pressures on gold towards the $1,500/oz level to persist.

The volumes are monthly and Turnover ratio is annualized (monthly trading volume annualised divided by the amount outstanding). UST Cash are primary dealer transactions in all US government securities. UST futures are from Bloomberg. JGBs are OTC volumes in all Japanese government securities. Bunds, Gold, Oil and Copper are futures. Gold includes Gold ETFs. Min-Max chart is based on Turnover ratio. For Bunds and Commodities, futures trading volumes are used while the outstanding amount is proxied by open interest. The diamond reflects the latest turnover observation. The thin blue line marks the distance between the min and max for the complete time series since Jan-2005 onwards. Y/Y change is change in YTD notional volumes over the same period last year.

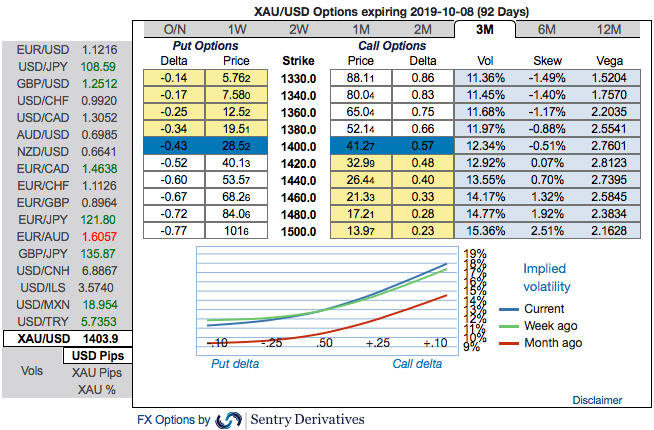

OTC Updates for Bullion Market: Please be noted that the positively skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, bids for OTM call strikes up to 1500 signifies hedging sentiments for the higher price risks. One could also see bullish risk reversal setup. To substantiate the above bullish sentiment, risk reversal (RRs) numbers indicate overall bullish environment.

The above risk reversal numbers have been known as a gauge of gold’s underlying market for bullish opportunities. Well, we know that options are predominantly meant for hedging a probable risk event in future.

Option Strategy:Capitalizing on the minor shift in risk reversal numbers of gold in the short-run and bullish neutral risk reversals of longer tenors, we advocate longs in gold via ITM call options.

Buy 3m XAUUSD ATM -0.70 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, we advocated long positions in CME gold contracts. We now like to uphold the same strategy by rolling over the contracts for August’19 delivery as we could foresee more upside risks. Courtesy: Sentrix & Saxo

Currency Strength Index:FxWirePro's hourly USD spot index was at -25 (mildly bearish), EUR is flashing at 99 (highly bearish), while articulating at (12:37 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand