Gold has recovered slightly more than $10 amid strong US dollar index. The yellow metal has lost more than $80 from high of $1341 made on Feb 20th 2019 on account of strong global markets and easing US-Sino trade tensions.

US dollar Index: Bullish. DXY has broken major resistance 97.71 high made on Mar 7th and jumped till 98.19. Overall trend is bullish and a jump till 98.60 likely.The index has formed a double bottom around 96.75` and any minor weakness only below that level.It is currently trading around 98.04. (negative for gold).

USD/JPY: Strong . USD/JPY is consolidating after hitting high of 112.16 level.The near term resistance is around 112.20 and any break above will take the pair to next level till 112.60/113.Negative for gold.

US 10 year yield : US 10 year yield is showing a minor decline after hitting high of 2.616%.It has jumped more than 11% from 14-month low of 2.34%. The yield has been trading weak for past four months and lost nearly 25% from high of 3.25%.It is currently trading around 2.525%. Slightly positive for Gold.

US 2 year yield: It is trading around 2.324%. The spread between US 10 year and 2 year has declined to 20bpbs from 30 basis point. The spread between 3 month and 10- year yield inversion has reversed (US 10 year yield trading above US 3 month).

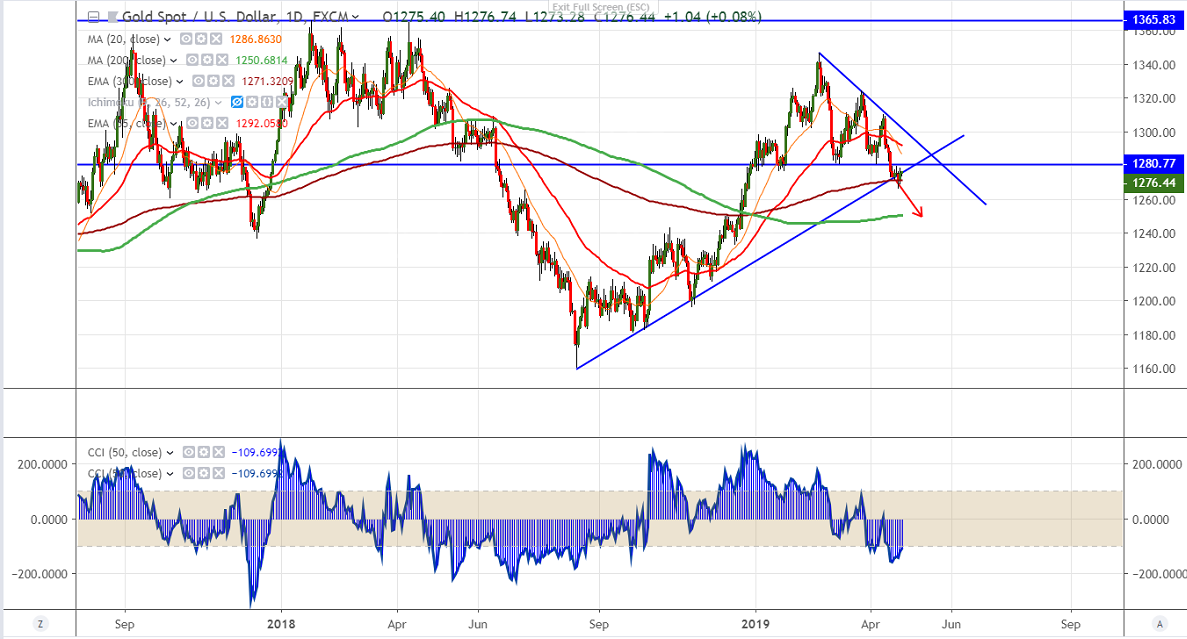

Gold technical

On the higher side, near term resistance is around $1281 and any convincing break above targets $1286/$1292. The yellow metal should break above $1292 for further bullishness.

The near term support is around $1266 and any break below will drag the commodity down till $1261/$1251.

It is good to sell on rallies around $1273-74 with SL around $1280 for the TP of $1261/$1251.