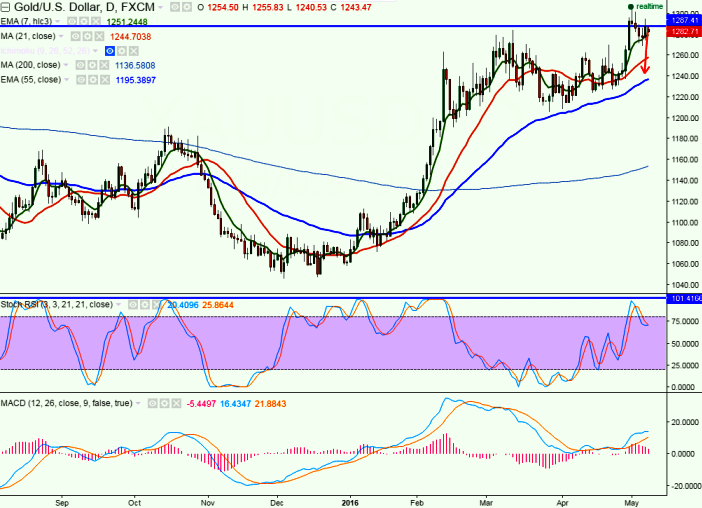

- Potential reversal Zone - $1303 (May 2nd high)

- Gold has once again retreated after making a high of $1295 on Friday. The yellow cannot able to hold above $1300 level and facing selling pressure at higher levels . It is currently trading around $1279.

- Gold has made a low of $1268 on Thursday and recovered from that level. Any break below $1268 (daily Tenken-Sen) will drag the commodity down till $1256/$1250/$1242 in short term.

- On the higher side major resistance is around $1303 and break above targets $1310/$1325/$1345 in short term.

- Short term trend reversal only below $1227.

It is good to sell on rallies around $1285-$1288 with SL around $1303 for the TP of $1251/$1242