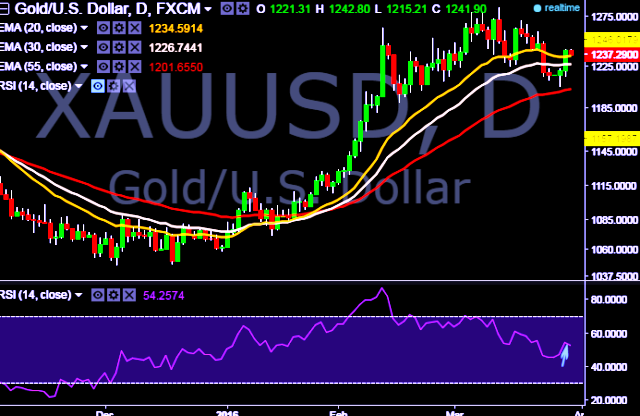

- XAU/USD is currently trading around $1237 mark.

- It made intraday high at $1242 and low at $1236 levels.

- Yellen kept her cautious approach regarding the monetary tightening pace, despite a faster-than-expected rise in certain inflation indices closely monitored by the Fed, while the labour market continued to show strengthening signs.

- Gold futures spiked 1.27% to $1,235.60 an ounce, extending the rebound from the one-month low of $1,208.00 touched on March 28, 2016.

- Intraday bias remains bullish till the time pair holds initial support at $1215 marks.

- A daily close above $1242 is necessary to turn the bias bullish again.

- On the top side, key resistances are seen around $1242, $1247 and $1252 levels.

- Alternatively, a sustained break below $1215 will drag the parity down towards key support levels at $1202, $1195 and $1190 marks.

- Later today U.S. will release ADP job data. This will provide further direction to the parity.

We prefer to take long position in XAU/USD around $1235, stop loss $1227 and target $1242/ $1247 marks.